Some of the push to raise tax revenue in Kansas is being couched in terms of fairness, as in, ‘why should one group be exempt from income tax but others must pay tax.’ The focus of those discussions are the businesses organized as Limited Liability Corporations (LLCs), partnerships and other business entities that are taxed as Individuals instead of Corporations.

There is another group that has been exempt from state income tax for decades – state and local government retirees’ pensions – but legislators and other tax-equity proponents have been oddly silent about the inequity of having private sector retirees pay income tax on their retirement benefits.

As explained in our 2011 publication of A Comprehensive Reform of the Kansas Public Employees’ Retirement System …

“KPERS benefits are not taxable for state income tax purposes. Employee contributions to the plan are after tax, so it’s appropriate that distributions from employee contributions would be not be taxable to avoid double taxation. However, KPERS members never have to pay state income tax on the majority of their pension benefits, which come from employer contributions and earnings on employer contributions.

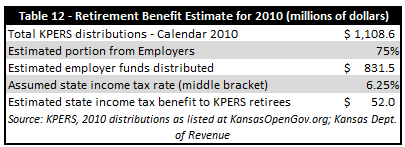

The cost to taxpayers of providing government retirees with these tax-free benefits is substantial. The exact amount of pension distributions from employer contributions and the applicable tax rate for each recipient would have to be identified to accurately calculate the benefit, but we can make a reasonable estimate. As noted in Table 4, in order to fully fund the state/school plan based on the market value of plan assets, the employer contribution rate would be 15.26% and the total employer and employee contribution rate would be 19.33%; the employer rate is therefore 78.9% of the total. For the KP&F plan, the employer rate would be 75% of the total (19.8% for the employer, 26.32% in total). The following estimate of a $52 million income tax benefit to KPERS retirees is based on the lower employer rate of 75%.”

Then-KPERS executive director Glenn Deck said our estimation of the tax benefit was reasonable. The current tax benefit should be similar; marginal tax rates have declined but pension distributions were $1.329 billion in 2013. But regardless of the actual amount, state and local government retirees are exempt from paying income tax on the portion of their pensions funded by taxpayers.

There is certainly a discussion to be had about fairness in taxation, but anyone proposing to increase or charge a tax based on fairness should be supportive of taxing government retirees the same as private sector retirees.