Bureau of Labor Statistics releases of June’s seasonally-adjusted private-sector jobs numbers show Kansas performing favorably with its regional peers through the first half of 2015 relative to the same period of time in 2014. Specifically, Kansas’ year-to-date growth rate of 1.23% achieves parity with Missouri (1.26%) and Oklahoma (1.27%) while besting Nebraska (0.89%) and trailing only Colorado (3.09%).

Beyond the region, Kansas’ 1.23% year-to-date growth rate compares to a 2.17% rate for its income-taxing peer states and a 3.27% rate for states without an income tax.

Last month’s jobs update highlighted the industry supersectors comprising private-sector job growth in Kansas and Missouri to illustrate how monthly, point-to-point job growth spikes or declines in individual industries can have disproportionate effects in coloring a state’s job outlook positively or negatively for any given month. For one, each month’s estimates are preliminary and are often revised either upward or downward as time passes. Secondly, industries that are well-developed in one state may be virtually nonexistent in another state. As such, spikes or declines in these industries can overstate one state’s job growths or declines relative to those of another. The release of numbers for June gives us six months of 2015 data with which to illustrate this idea.

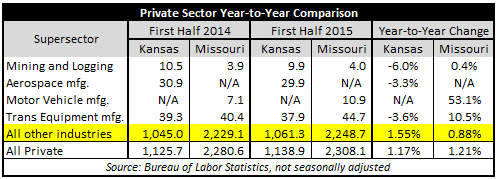

The adjacent table (with jobs reported in thousands and not seasonally adjusted) shows that Kansas experienced overall private-sector job of 1.17% compared to Missouri’s 1.21%. Unpacking each state’s growth individually though shows that Missouri experienced 53.1% year-to-date growth in the motor vehicle manufacturing industry. This is an industry that is essentially nonexistent in Kansas by virtue of being too small to meet BLS minimum reporting requirements. Similarly, Missouri’s aerospace manufacturing sector is also too small to report. Yet, the aerospace sector has a large footprint in Kansas, leaving Kansas uniquely affected by larger-scale, global fluctuations the sector undergoes even outside of the Sunflower State. Finally, the mining and logging sector—which encompasses oil and gas extraction—is one that can be measured in both Kansas and Missouri. However, this sector is also a largely global one that subjects Kansas and Missouri to larger-scale fluctuations in supply and demand that are outside of their control through state-level policy prescriptions or otherwise.

Just looking at “all other industries” outside of the four discussed above that are either disproportionately global or particularly active in one state but not in the other paints a far different private-sector job growth picture. By this measure, Kansas’ 1.55% year-to-date growth outpaces Missouri’s 0.88% growth by a wide margin. This finding is consistent with our contention from last month’s update that surface-level jobs numbers do not tell the whole story when it comes to signaling the overall health of a state’s economy. Instead, one must dig deeper to understand that economy’s moving parts while also separating monthly anomalies from potentially longer-term trends.