For six months Kansas sales tax on retail spending has deteriorated. There was no sign of a holiday shopping bump in the state’s tax revenue report.

See the November Fiscal Year 2019 Report click here.

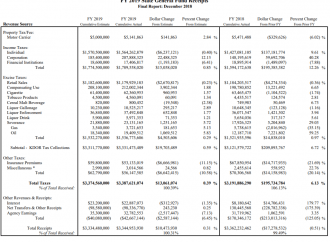

The Governor’s Budget Office reported state government tax collections for the fiscal year ending in December.  Kansas state government collected $196 million in taxes compared to the same 6 months last year. More than 50% was driven by individual income taxes, which saw a record-setting increase in rates. Sales tax receipts performed worse. In the last report sales tax purchases were down roughly $2 million. Now it has fallen by $4 million.

Kansas state government collected $196 million in taxes compared to the same 6 months last year. More than 50% was driven by individual income taxes, which saw a record-setting increase in rates. Sales tax receipts performed worse. In the last report sales tax purchases were down roughly $2 million. Now it has fallen by $4 million.

Across the country, retail sales for the month of November grew 4.2% over November of 2017. With prices growing 2.2% over the same time period, Americans on average purchased an 2.0% more goods and services than they did last year (4.2% minus 2.2%). For Kansans, take away that 2.2% growth in prices and they bought fewer goods and services.

Why are Kansas sales sluggish while the rest of the country enjoys a robust holiday shopping season? We address some common questions.

1. Are Kansans hopping state lines to shop?

While that is possible, the latest tax revenue report from Missouri shows sales tax revenues on consumer spending up more than 2 percent for their fiscal year. While that growth rate pales relative to the national average, at the very least it keeps up with inflation. That cannot be said for Kansas sales tax revenues. Therefore, it suggests Missouri is not seeing an sizable influx of Kansans shopping.

2. Is online shopping diverting activity from Kansas sales tax?

This is also likely possible. However, the presence of online shopping is not a new phenomenon but has been present since the 90s. Since then state government has seen periods of robust sales tax activity. In fact, for the first two quarters of 2018 sales tax collections were growing well beyond inflation. Large online retailers like Amazon already send sales tax to the state. Companies like Overstock.com and Wayfair will also send sales tax to the Kansas government due to the Wayfair decision . While online sales are a diversion that should be addressed appropriately, there is little evidence that it is a pressing issue in the last six months.

There is perhaps another reason why sales tax on Kansans’ purchases remains sluggish. A 40-year long stagnating economy means Kansans don’t have the income and spending as great as the rest of the country. What is holding back that income and spending potential? Well the state has the 8th highest sales tax in the nation. It also has high excise and property tax rates, and just raised state income taxes three times in the past two years. Kansas government, through its fiscal policy, is growing the tax burden on Kansans. The higher the burden on citizens, the less freedom they have and the slower the economy grows. As a result, either more Kansans are living paycheck to paycheck or they are saving paychecks in order to accommodate the higher tax atmosphere. Regardless it seems that Kansans don’t have the take home pay to satisfy their wants like they used to.