Listening to a lot of legislators, one might think their constituents are demanding that their income taxes be increased but a new market research study shows a major disconnect between Topeka and the rest of the state. SurveyUSA conducted the study on behalf of Kansas Policy Institute between February 3 and February 8; with participation of 501 registered voters, the survey has a Credibility Interval of ± 4.5 percentage points.

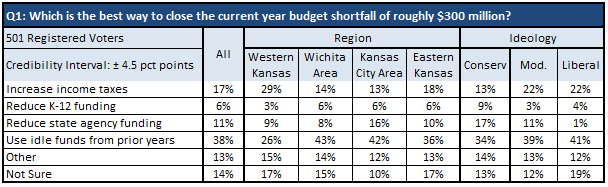

Asked how legislators should close the current year budget shortfall, the #1 response (38 percent) favors using idle funds left over from prior years. An income tax increase came in second at 17 percent but another 17 percent want other spending reduced. Collectively, 55 percent of respondents say legislators should do something other than raise the Kansas income tax.

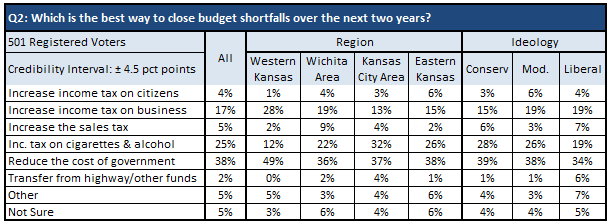

To close shortfalls over the next two years, a plurality of Kansans (38 percent) say to reduce the cost of government, followed by increasing the tax on cigarettes and alcohol (25 percent); increasing the Kansas income tax on business came in a distant 3rd at 17 percent.

To close shortfalls over the next two years, a plurality of Kansans (38 percent) say to reduce the cost of government, followed by increasing the tax on cigarettes and alcohol (25 percent); increasing the Kansas income tax on business came in a distant 3rd at 17 percent.

The Kansas Senate is considering a mix of spending reductions and use of idle funds for this year but tomorrow morning the Senate takes up debate of Senate leadership’s income tax proposal that would take $1.8 billion more out of Kansans’ pockets over the first five years. Their plan includes eliminating the tax exemption for small business pass-through income, increases the Kansas income tax rates for all citizens and even removes the tax exemption for single people with taxable income below $5,000 and married couples with taxable income below $12,500.

Some people cite the November elections in Kansas as proof that citizens wanted legislators who would increase taxes but that may just be wishful thinking on the part of those who prefer higher taxes and more spending. Similar surveys over the years consistently reflect Kansans preference for efficient government over tax increases but many legislators had no interest in cost control; instead, they increased taxes and spending in 2013 – and then they did it again in 2015.

Maybe Kansans thought changes were needed to get costs under control.