So far, the most pro-government/anti-freedom Legislature in recent history hasn’t been successful in efforts to eliminate right-to-work, strip citizens of their right to vote on property tax increases, reinstate prevailing wage or allow local government to set minimum fringe benefit standards for private employers, but this week they stuck citizens with an unnecessary $3 billion Kansas income tax increase over five years. Indeed, some of the same legislators who railed against the regressive 2015 sales tax increase not only allowed that tax to stay in place, they voted to impose double-digit income tax increases on low and middle income families.

Those voting for the largest tax hike in history cannot claim they were responding to the will of the people; surveys by Fort Hays State University, the Kansas Chamber of Commerce and Kansas Policy Institute each showed citizens wanted spending cuts to be the primary method of balancing and they strongly opposed a personal income tax increase on the middle class.

And they can’t say they had no other options. The Kansas Truth Caucus and Kansas Policy Institute showed multiple ways to balance the budget without any tax increase. Some of the options weren’t ideal policy, like securitizing tobacco settlement money, but each is better for Kansans than an unnecessary tax increase.

Their action is best explained by economist Thomas Sowell. “No one will really understand politics until they understand that politicians are not trying to solve our problems. They are trying to solve their own problems — of which getting elected and re-elected are No. 1 and No. 2. Whatever is No. 3 is far behind.” Special interests that profit from excess government spending write big campaign checks and have media on their side, so the easiest way to solve Problems No.1 and No. 2 is to do their bidding.

The $3 Billion Increase

Many legislators wanted something closer to a $5 billion Kansas income tax increase over five years, but here’s the damage for which they ‘settled’…if one can calling unnecessarily removing $3 billion from the private economy ‘settling.’

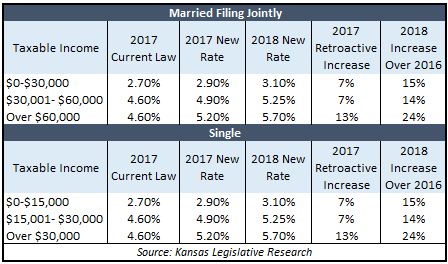

Marginal tax rates on all individuals are increased retroactive to January 1, 2017 and then hiked again in 2018. So not only will your employer have to withhold more from your paycheck starting July 1, you’ll either have to further increase withholding or write a check next April for the tax increase on your earnings for the first half of this year.

The rate on the first $15,000 single / $30,000 married taxable income jumps 15 percent by next year, going from 2.7 percent to 3.1 percent. A new second bracket on the next $15,000 single / $30,000 married taxable income goes up 14 percent and there’s a 24 percent increase of every dollar of taxable income thereafter. The rate increases for those who itemize will be partially offset by the phase in of deductions for mortgage interest and medical expenses (50 percent this year and next, 75 percent in 2019 and 100 percent in 2020.). The child care tax credit will be brought back in 2018 at 12.5 percent of the allowable federal amount and moving to 18.75 percent in 2019 and 25 percent thereafter.

The rate on the first $15,000 single / $30,000 married taxable income jumps 15 percent by next year, going from 2.7 percent to 3.1 percent. A new second bracket on the next $15,000 single / $30,000 married taxable income goes up 14 percent and there’s a 24 percent increase of every dollar of taxable income thereafter. The rate increases for those who itemize will be partially offset by the phase in of deductions for mortgage interest and medical expenses (50 percent this year and next, 75 percent in 2019 and 100 percent in 2020.). The child care tax credit will be brought back in 2018 at 12.5 percent of the allowable federal amount and moving to 18.75 percent in 2019 and 25 percent thereafter.

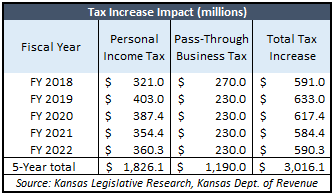

Don’t be fooled by claims that taxes are still lower than in 2012. The marginal rates may be lower but the sales tax and cigarette tax increases instituted since then remain in place. According to an analysis from the Kansas Department of Revenue, the net effect of all taxes changes between 2012 and 2016 was only a $393 million tax reduction for Fiscal 2018; the $591 million Kansas income tax hike just imposed for Fiscal 2018 means citizens will be $198 million worse off next year on net than in 2012.

Of the $3 billion total increase tallied by Kansas Legislative Research, the Kansas Department of Revenue says $1.2 billion is attributable to elimination of the pass-through exemption (presuming, of course, that none of those businesses pick up and leave). The remaining $1.8 billion tax increase means the ordinary citizens are stuck with 61 percent of the total increase.

Of the $3 billion total increase tallied by Kansas Legislative Research, the Kansas Department of Revenue says $1.2 billion is attributable to elimination of the pass-through exemption (presuming, of course, that none of those businesses pick up and leave). The remaining $1.8 billion tax increase means the ordinary citizens are stuck with 61 percent of the total increase.

The exemption on pass-through income for proprietors, partnerships, limited liability corporations (LLCs) and sub-S corporations is eliminated effective January 1, 2017. That income passes through to the individuals owners and is therefore taxed at the above marginal rates.

The Legislature that theoretically opposes balancing the budget on the backs of poor people also put many of the lowest earners back on the tax rolls. Previous law exempted the first $5,000 of taxable income for single filers and the first $12,500 for married filers; those exemptions are reduced to $2,500 and $5,000 respectively.

But don’t worry…legislators and other state employees are still exempt from paying Kansas income tax on most of their government pension income.