Articles Filtered By:

Tax Policy

KPI & Show-Me Institute Oppose Stadium Bidding War

June 17, 2024

A Responsible Kansas Budget

January 10, 2022Subsidies Do Not Equal Economic Growth in Kansas

December 9, 2021

Lockdown effect means 57,000 fewer private jobs

March 15, 2021

The real cost of Government “free stuff”

February 25, 2021

Kansas RELIEF Act can spur COVID Recovery

February 15, 2021

Kelly’s budget raises taxes during recession

January 14, 2021A Kansas Budget for Economic Growth & COVID Protection

January 4, 2021

Legislature could turn incoming fiscal shortfall into savings

November 18, 2020Small businesses re-plummet despite state economic planning

September 8, 2020

STAR Bonds redirect jobs, not create them

August 28, 2020Gov. Kelly plays politics with federal unemployment relief

August 24, 2020Kansas 2019 Private Jobs Grows Slower Than Expected

March 16, 2020Kansas media spins job growth

March 2, 2020STAR Bonds taint Kansas’s role as a referee

February 20, 2020

Gov. Kelly’s 2020 budget: Five things you should know

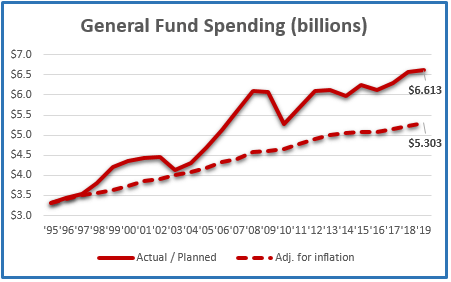

January 20, 2020Kansas economy ranks 49th as government grows

November 26, 2019Income inequality is about choice not “fairness”

October 16, 2019

Kansas deficit-spends into a billion dollar hole

October 10, 2019Kansas Tax Increase Unfairly Burdens The Poor

August 12, 2019It’s Official: Governor’s Budget Sets Up A $1.3 Billion Tax Increase

February 19, 20192019 Legislator’s Budget Guide: Reversing The Kansas Exodus

January 4, 20192019 Legislator’s Budget Guide: Economic Development Needs Reform

December 19, 2018

2019 Legislator’s Budget Guide

November 28, 2018Taxing Online Sales Isn’t A Kansas Windfall

November 2, 2018Politicians are ignoring a $3.7 billion revenue shortfall

September 17, 2018Kansas legislators might raise taxes again

April 29, 2018

Online sales tax a ruse to grow government

April 29, 2018Kansas #26 in “Rich States, Poor States”

April 29, 2018

Taxpayer Choice: Grow Government or Help Kids

July 26, 2017

Kansas Legislature Broke a Lot of Promises

June 15, 2017A tax on your income tax?

May 10, 2017

Pass-Through Exemption Helped Add 18,000 jobs in 2015

April 23, 2017PEAK subsidy costs Kansas $48.5 million annually

April 19, 2017States that Spend Less, Tax Less…and Grow More

April 7, 2017Kansas House passes $2.4 billion income tax increase

February 16, 2017Brownback’s budget proposal pretty good overall

January 12, 2017State think tanks lead the fight for freedom

December 19, 2016Governing isn’t about granting wishes

November 28, 2016

Pass-through entities drive job growth in Kansas

October 31, 2016