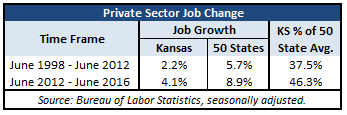

Private sector jobs grew 4.1 percent over the last four years (June to June). While that is less than the national average of 8.9 percent, it is a better performance to the 50-state average than over the previous fourteen years. Private sector job growth for Kansas was only 2.2 percent between June 1998 and June 2012, or 37.5 percent of the national average, but jobs grew at 46.3 percent of the 50-state average over the last four years.

Job growth is often used as a litmus test for the efficacy of tax reform, but average growth rates can mask unusual fluctuations that are unrelated to state tax policy.

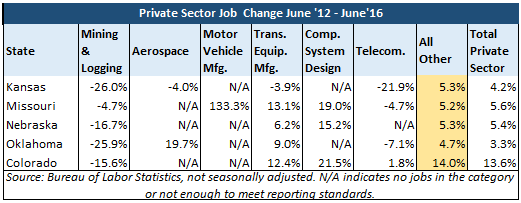

Consider the table below comparing post-tax reform job growth in Kansas to that of its regional peer states. Separating growth in six nationally and globally-driven industries from “All Other” industries shows Kansas and Oklahoma each performing a full percentage point better than they do when looking at “Total Private Sector” job growth. The “All Other” industries group still comprises anywhere from 92% to 97% of each regional state’s private sector economy. Instead of being in 4th place in the region, we see that Kansas is tied for #2.

So, why do these six industries in particular exert such a disproportionate influence on reported job growth?

So, why do these six industries in particular exert such a disproportionate influence on reported job growth?

For starters, the mining and logging industry includes oil and gas extraction, and Kansas is much more reliant on oil & gas than most regional states. The same is true of aerospace.

Job growth in the transportation equipment manufacturing, auto manufacturing, and computer system design industries can be driven by demand for a particular product that is produced almost exclusively in one or more regional states but not others.

Telecommunications provides a final, more local example of job growth and decline affecting reported numbers but having little to do with state tax policy. Specifically, recent job losses at Sprint Corporation—based in Overland Park, Kansas—continue to disproportionately influence industry job reports for Kansas.

Overall, as the examples throughout this post show, it is not enough to simply accept reported jobs numbers at face value. Instead, they should be examined with perspective and context alongside a host of other indicators of state economic vitality.