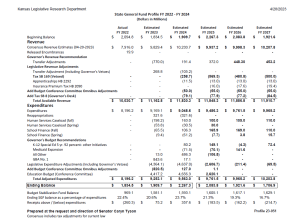

Last night, the Kansas senate failed to overrule Governor Kelly’s veto of SB 169, a bill that would have established a flat tax and sped up the elimination of the food sales tax amongst other forms of relief. It’s disappointing that with a massive $3 billion predicted budget surplus in FY 2024 WITH SB 169 built into the estimate, this relief couldn’t be passed to help ordinary Kansas families and businesses. And considering Kansas’s job loss last month, relief is desperately needed to say afloat. The legislature may still be in session, but it appears that meaningful tax reform is dead for 2023.

According to the Bureau of Labor Statistics, In March 2023, Kansas lost 0.2% of its private sector jobs, the same as last month. 38 other states across the country had positive growth rates or lost a small percentage of jobs relative to their economy. Similarly, Kansas is 1.8% above its pre-pandemic, January 2020 jobs number, but 28 other states are beating out Kansas in this metric as well.

According to the Bureau of Labor Statistics, In March 2023, Kansas lost 0.2% of its private sector jobs, the same as last month. 38 other states across the country had positive growth rates or lost a small percentage of jobs relative to their economy. Similarly, Kansas is 1.8% above its pre-pandemic, January 2020 jobs number, but 28 other states are beating out Kansas in this metric as well.

Seven of the nine non-income taxing states had a stronger monthly growth rate than Kansas. Similarly, seven of the nine non-income taxing states also have a larger percentage of jobs gained relative to January 2020 when compared to Kansas. While March was a poor month for many states across the county with dozens experiencing job loss big and small, states that have enacted innovative tax reform in recent history tended to weather it better. North Carolina grew by 0.2% and is 7.5% above January 2020 job levels while citizens of dozens of other states saw their opportunities diminish.

Kansas stayed at an unemployment rate of 2.9% – the same as it’s been since November 2022. The labor force participation rate increased though from 66.4% to 66.6%. People want to go out and find jobs, but Kansas’s sluggish economy isn’t providing them.

Between 1998 and 2021, Kansas ranked 44th for private-sector job creation by the Bureau of Economic Analysis. Recent politics have tried to remedy this with megasubsidies like APEX that have incentivized Panasonic and Integra Technologies to invest in new facilities in Kansas. But these projects are not worth the price tag when it comes to growth. The $1.8 billion Integra facility claims to offer 2,000 jobs in return for $300 million in subsidies from the state. That’s an estimate of $150,000 in taxpayer cash per job.

Meanwhile, between 2013 and 2014, 82% of the private-sector jobs created in Kansas were in pass-through businesses at a rate that was three times greater than before the Brownback tax cuts. While megasubsidies bring jobs on paper, the long-term growth comes from small businesses. It comes from start-ups. It’s a slap in the face to hard-working Kansans that billion-dollar companies can receive hundreds of millions of dollars on a whim. But they can’t get a penny of tax relief.

Kansas goes another year with significant tax relief. The people experiencing the consequences of this are workers, small businesses, and families who have struggled with inflation and now can’t get a break while the state rolls in their cash.