A recent Kansas City Star editorial says that In the Kansas City area, jobs aren’t fleeing Missouri after Kansas tax cuts, but as is often the case, they set up a straw man argument (e.g., “fleeing” isn’t the issue) and make selective use of data to make their point. A conclusive analysis of the efficacy of tax reform will require many more years of data but there a number of encouraging early signs that the Star overlooks.

First of all, the Star doesn’t disclose that nonfarm jobs is the basis of their editorial, which is the total of government and private sector jobs. Another Star editorial calling out Kansas Policy Institute a few days ago said it is “utter nonsense” to measure the health of an economy by growth in the private sector rather than government. The Star hasn’t said whether they will allow a response at this writing, but we disagree with their position. The money to fund government comes from the private sector; further, government can grow by overtaxing and suppressing private sector growth.

It is hard to imagine that their failure to disclose the inclusion of government is a coincidence, but let’s keep the focus on nonfarm jobs for now in order to demonstrate another issue with their analysis.

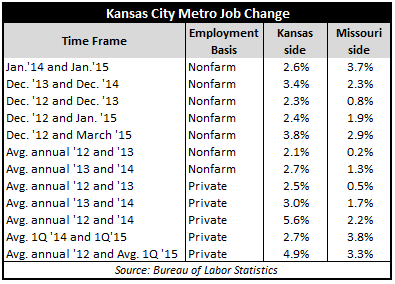

The Star uses point-to-point comparisons of January 2014 and January 2015 to make their case that the Missouri side of the Kansas City Metro is growing faster than the Kansas side. The problem with point-to-point comparisons is that one or both points can be unusual spikes or declines. The Bureau of Labor Statistics also publishes average annual employment, which minimizes the impact of any single data point.

Shifting the analysis by one month and comparing December employment for 2013 and 2014 shows that Kansas outperformed Missouri 3.4 percent to 2.3 percent, the opposite of their position. The Star says Missouri did better than Kansas since tax reform was enacted but they compare January 2013 and January 2015; December 2012 is the last month before tax reform was implemented and with that as the base, Kansas beat Missouri.

Kansas nonfarm jobs grew by 2.4 percent between December 2012 and January 2015 whereas Missouri increased by 1.9 percent.

It’s also interesting that the Star used January data for their post-tax reform comparison rather than the most current March data; the Kansas margin is even wider, at 3.8 percent compared to 2.9 percent for Missouri.

The more stable comparisons of average annual employment also show Kansas to be the clear winner, whether using nonfarm jobs or the more pertinent measure of private sector employment. Using nonfarm jobs, Kansas beat Missouri in 2013 by a margin of 2.1 percent to 0.2 percent and won again in 2014 by a margin of 2.7 percent to 1.3 percent. Using private sector jobs, Kansas beat Missouri in 2013 by a margin of 2.5 percent to 0.5 percent and won again in 2014 by a margin of 3.0 percent to 1.7 percent.

Moving now to private sector job growth, Kansas outperformed Missouri in the first two years since tax reform, 5.6 percent versus 2.2 percent. Missouri is doing better than Kansas in the first quarter of 2015, with a preliminary lead of 3.8 percent to 2.7 percent but comparing average annual jobs for the first quarter of 2015 with the 2012 average still favors Kansas, 4.9 percent to 3.3 percent.

Kansas is showing even better progress on statewide job growth. Private sector jobs only increased by 2.2% between 1998 and 2012 (average annual jobs for 1998 and 2012, seasonally adjusted); that growth rate put Kansas at #38 among the fifty states. In 2013, private sector employment grew 1.6% and Kansas was ranked #27 in the nation. Last year Kansas moved up to #21 with growth of 1.9%.

Kansas almost reached parity with its income-taxing peers last year, which is also a significant improvement in competitiveness. Kansas private sector jobs grew at just 61% of its income-taxing peers’ 3.6% growth rate between 1998 and 2012, but 2013 and 2014 growth was at 78% and 95%, respectively. Kansas job growth was also better in 2014 than the neighboring states of Missouri, Oklahoma and Nebraska.

Job growth isn’t the only measure by which Kansas is outperforming Missouri. The extent to which tax reform should be credited for the improvement cannot be determined but the shift in performance is quite noteworthy.

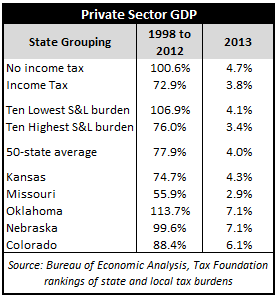

Private sector GDP isn’t available yet for 2014 but Kansas outperformed the 50-state average in 2013, as well as its income-taxing peers and the ten states with the highest state and local tax burden (as ranked by The Tax Foundation). Kansas trailed each group in the fourteen years preceding tax reform.

Rankings among neighboring states didn’t change; Kansas widened its lead over Missouri but was less competitive with other neighboring states in 2013. One year certainly doesn’t qualify as a trend but it’s encouraging to see Kansas more competitive on a national scale.

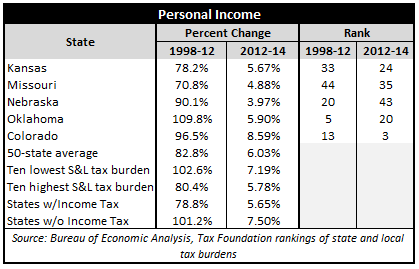

Data on Personal Income growth is available for 2014, however, and Kansas has improved in the two years since tax reform was enacted on several measures.

Total personal income in Kansas (which includes dividends, interest, rent, wage and salary earnings, proprietor earnings, employer payments for payroll taxes, health care and retirement plus government transfer payments for government and the private sector) increased by 5.67% between 2012 and 2014, ranking #24 in the nation and much better than its #33 ranking between 1998 and 2012. Kansas did slightly better than the states that tax income and was closer to the performance of the 50-state average. Kansas outperformed Missouri and Nebraska and was more competitive with Oklahoma.

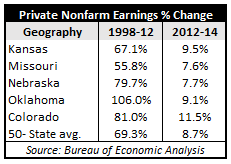

Kansas also shows improvement in Nonfarm Private Earnings, which includes all nonfarm private sector components of Personal Income. Kansas trailed the 50-state average in the fourteen years prior to tax reform but its 9.5 percent growth over the last two years exceeds the 8.7 percent average of all states. Kansas also outperformed Missouri, and while not unusual, the margin of victory has widened. Kansas trailed Nebraska and Oklahoma in the past but has pulled ahead in the last two years.

None of this means that tax reform can be declared a success yet as one or two years is not near enough time to make such a judgement, but the early signs are encouraging.