Last week, Governor Laura Kelly kicked off this year’s legislative session by releasing her FY 2025 Budget Report. Inside are her policies that she wants to pass this year and the spending that they’ll require out of the budget. There are some good policies in there, but also many that aren’t effective or would shift the tax burden.

The Good

Good here is a relative term here: tax relief is good, however, there are some forms of tax relief that produce greater savings and more effective for economic growth than others.

The report has some tax relief that is well overdue, such as exempting Social Security income from the state income tax. For context, private retirement plans like IRAs, 401ks, certain Social Security benefits, and out-of-state public pensions are all fully taxed, though public sector pensions are not. Kelly is also proposing an increased standard deduction and an early elimination of the food sales tax – two policies that return less than $100 million to taxpayers, but are certainly helpful.

If some of these policies sound familiar, it’s because they are: they were all in SB 169 last year, the flat tax bill that Kelly vetoed. Some of the senators supporting her plan changed their votes to sustain the veto as well. Her ideas simply do not go far enough to help families and take some sting out of inflation.

These policies are good, but Kansans could have had the relief last year if Governor Kelly didn’t veto the bill. Kelly is quick to denounce the flat tax as “Back to Brownback,” but Kansas would had a $4.5 billion surplus after four years of the flat tax if her veto had been overridden last spring. Changes to the income tax produce the most change in economic standing and people’s incentives to work. Studies of flat taxes in Europe have found that their implementation increases the number of people working and the number of hours they work, with the most significant effects coming with tax cuts for people with lower incomes

The Bad

Her top proposal this year is to expand Medicaid. However, there are concerns that Medicaid would bloat the state budget, even beyond projections, while not effectively serving patients.

Costs per enrollee for Medicaid expansion are 64% higher than projected. In 2020, one in five dollars spent in Medicaid was an improper payment, totaling $86 billion in waste nationwide in that year alone. Only 20-40 cents of every dollar spent on Medicaid directly improves the welfare of recipients. Medicaid could significantly alter the state’s budget and require higher taxes in the future. Not to mention the fact that Medicaid spending is built on the back of federal debt, which in turn has interest and high costs into the future.

The costs come from the expansion of thousands of more able-bodied adults into the system. In Montana, for instance, original estimates of enrollment were at 59,000. But today, the total amount of enrollees is 125,034. There are more able-bodied adults enrolled than children enrolled there. From 2015 to 2022, the state spending on Medicaid has gone from $1.1 billion to $2.3 billion and continues to take a larger share of their budget.

After all of this, Medicaid patients wait longer and are less likely to successfully schedule primary care appointments than private insurance holders.

The Ugly

Kelly’s budget contains $54 million to restore the Local Ad Valorem Tax Reduction (LAVTR) plan, which hasn’t been funded since 2003 because local officials used the state money to spend more and imposed property tax increases averaging 7.6% annually in the program’s last five years. By comparison, property tax increases went up by 3.9% annually on average from 2018 to 2022.

No budget proposal would be complete with a tax holiday – this one for back-to-school sales. While they seem nice on paper, tax holidays rarely provide significant relief compared to permanent rate reductions elsewhere.

Conclusion

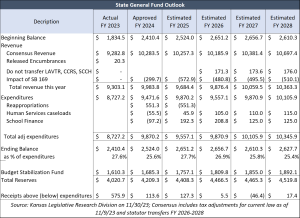

For as much as Kelly shuts down attempts at tax reform for fear they’ll “bust the budget,” her recommended budget for FY 2025 is about $2.25 billion higher than the actual budget for FY 2023 and $1.3 billion higher than the current base budget for FY 2024.

Hopefully this year, the assortment of small relief she proposes can be transformed into something more substantial.