Kansas has a high debt burden, but it long predates the current administration, current tax policy, and the current legislature. This fact contradicts media’s misleading use of a September 2016 report from Truth in Accounting to imply that Kansas’ unfunded pension liabilities and broader debt burden have primarily been products of the state’s current budget concerns and tax reform efforts.

Indeed, the Truth in Accounting report is misleading in its own right with its assuredly headline-grabbing use of the term taxpayer burden to represent what is really an accumulated debt burden. Yes, taxpayers pay for debt eventually, but debt does not have to pose an increased cost to taxpayers or exist at all if legislators make efficient use of existing resources to address current and avoid future debt.

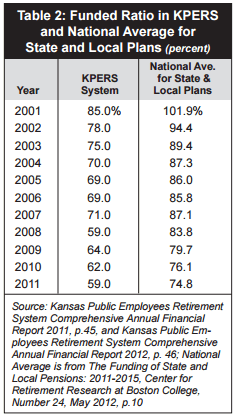

Yet, as the table below from KPI’s 2013 paper on the need for pension reform in Kansas shows, Kansas’ history of pension debt is vast and spans both Republican and Democratic leadership.

Governors Finney, Graves, Sebelius, and Parkinson all proceeded to under-fund the Kansas Public Employee Retirement System (KPERS) with the help of their legislative counterparts even in years when money to fund it adequately was readily available.

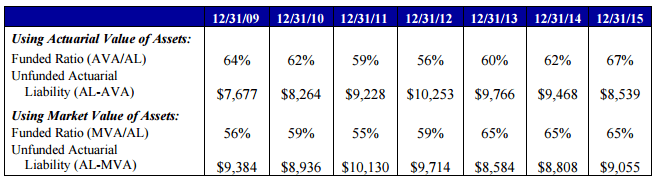

The table below comes from the most recent, July 2016 KPERS Valuation Report. It shows increases in KPERS’ funded ratio since 2009 by both actuarial and market-value standards. However, it also signals work to be done.

Reported funding ratios and unfunded liability are based on KPERS’ assumption that investments will yield an 8 percent annual rate of return, which most pension experts say is grossly overstated. In fact, as page 5 of the KPERS Valuation Report shows, KPERS investments earned just 0.2% in 2015. A new state pension analysis by the American Legislative Exchange Council uses a more realistic, risk-free investment return rate of 2.34 percent, which produces a KPERS unfunded liability of $40.7 billion and a funded ratio of just 29.9 percent.

Media, special interests, and legislators calling for tax increases in order to address Kansas’ pension debt would do well to remember the legislature’s longstanding bipartisan penchant for spending every penny it can find rather than setting aside funds to meet future obligations. Furthermore, this says nothing of the negative economic impacts tax increases bring, further complicating funding efforts.

Serious discussions about reducing our state’s pension liabilities must consider placing new and non-vested employees in a defined contribution plan. This would offer workers true retirement security by providing them with up-front employer match funds for investment rather than promising them a future benefit that hinges not only on the state meeting its obligations but also on meeting the unrealistic investment returns it has forecasted. A properly constructed DC plan would also make government pensions fully taxable and base legislators’ retirement on actual earnings, eliminating special treatment for government employees.

Additional reforms should—to the extent possible— look to end the practice of pension “double-dipping,” whereby state employees eligible for early retirement are able to draw pension benefits while working in another position.

Undertaking these reforms will go a long way toward addressing Kansas’ pension debt burden before it becomes unmanageable and leaves taxpayers holding the bag after decades of government kicking the proverbial can down the road.