Articles Filtered By:

KPERS

Over 3,700 KPERS Millionaires in 2022

June 2, 20232022 Kansas Payrolls: $2.36 billion

May 16, 2023

Bill prohibiting state investment in ESG moves forward

April 14, 2023

ESG-related bills stir discussion in Kansas

March 21, 2023Think Long-Term Relief with FY 2022 Tax Revenue

July 6, 20222021 Kansas Payrolls: $2.26 billion

May 13, 2022Ideas for ARPA and Kansas Revenue Cash Pile

February 9, 2022Achievement gaps persist despite KSDE claims

December 13, 2021Reversing years of Kansas fiscal mismanagement

November 9, 2020

Gov. Kelly’s 2020 budget: Five things you should know

January 20, 2020

2019 Legislator’s Budget Guide

November 28, 2018Politicians are ignoring a $3.7 billion revenue shortfall

September 17, 2018

Kansas Legislature Broke a Lot of Promises

June 15, 2017$11 Billion School Debt Exceeds State Debt

June 5, 2017Fake news in Kansas promotes political agenda

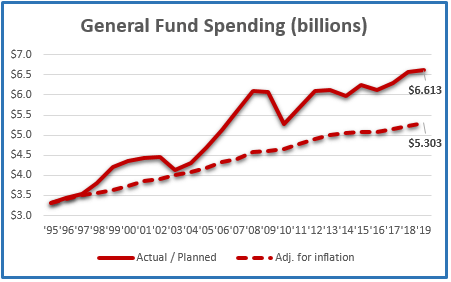

March 28, 2017Kansas budget can be balanced without tax hikes

February 28, 2017KPERS Debt Created under Previous Administrations

October 17, 2016

Inaugural Podcast with Dave Trabert

January 19, 2015