Contrary to claims that local officials are ‘holding the line’ on property tax increases, local government entities averaged a 4.5% increase in 2019. That’s three times the inflation rate of 1.5%. Education property taxes – mostly for public schools and community colleges – increased 3.6% last year according to the Kansas Department of Revenue’s 2019 Statistical Report of Property Assessment and Taxation.

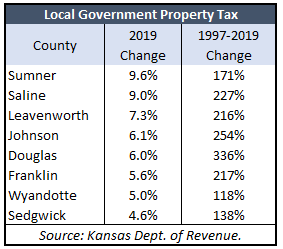

Local government entities in two counties (Grant, 18.8% and Pottawatomie, 10.3%) imposed increases over 10%; this accounts for all local government units, including the county, cities, townships, fire districts, etc.). Tax increases for local government operations in 31 counties exceeded the state average, including some of the state’s largest counties shown in the adjacent table.

Local government entities in two counties (Grant, 18.8% and Pottawatomie, 10.3%) imposed increases over 10%; this accounts for all local government units, including the county, cities, townships, fire districts, etc.). Tax increases for local government operations in 31 counties exceeded the state average, including some of the state’s largest counties shown in the adjacent table.

Sumner county local units of government collectively imposed a 9.6% property tax increase last year. Local government taxes increased 9% in Saline County, 7.3% in Leavenworth County, 6.1% in Johnson County, 6% in Douglas County, 5.6% in Franklin County, 5% in Wyandotte County, and 4.6% in Sedgwick County.

Total property tax revenue topped $5.1 billion last year, not including penalty tax and payments in lieu of taxes. Real estate taxes have increased 221.5% since 1997; that’s more than four times the inflation rate of 52% (Consumer Price Index for Midwest Cities). The two largest real estate categories – Residential and Commercial/Industrial – increased 233.5% and 216.8%, respectively, since 1997. Personal property taxes increased 30.7% since 1997.

Property tax in Kansas increased by $202 million last year, with local units of government imposing $120.3 million more, public schools and community colleges adding $79.1 million, and property tax for state buildings going up by $2.5 million. Statewide, local government accounts for 55% of all property tax; education consumes 44% and 1% goes for state operations.

Property tax in Kansas increased by $202 million last year, with local units of government imposing $120.3 million more, public schools and community colleges adding $79.1 million, and property tax for state buildings going up by $2.5 million. Statewide, local government accounts for 55% of all property tax; education consumes 44% and 1% goes for state operations.

Local government opposes property tax transparency law

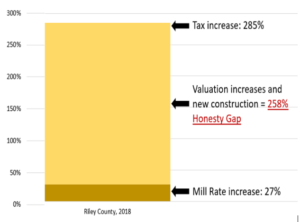

Kansans repeatedly complain about writing checks for higher and higher property tax while many local officials profess to be ‘holding the line’ on property taxes. Riley County, for example, raised property tax for county operations by 285% since 1997 but  the mill levy is only 27% higher. That large, 258% difference has created an ‘honesty gap’ in taxpayers’ minds.

the mill levy is only 27% higher. That large, 258% difference has created an ‘honesty gap’ in taxpayers’ minds.

In response, state lawmakers are considering legislation to require local officials to vote on the entire property tax increase, regardless of whether caused by valuation changes, new construction or the mill levy itself. Senate Bill 294 is based on Truth in Taxation laws in Utah and Tennessee that have been in effect for decades and have successfully kept effective tax rates low.

Since 2000, Utah’s effective property tax rate (taxes paid divided by total appraised value) dropped 7.5% while in Kansas, the rate jumped 22%.

Under SB 294, local elected officials must vote on the entire property tax increase they impose, regardless of whether the increase is caused by valuation changes or mill rate changes. Each year, mill rates would be automatically reduced to a ‘revenue-neutral’ rate that produces the same property tax revenue to each city and county as they collected the year before. If they want to raise the revenue-neutral mill rate, they must notify taxpayers of their intent and hold public Truth in Taxation hearings to accept taxpayer input. Afterward, they must vote on the entire tax increase they decide to impose.

75% of registered voters in Kansas support this plan and only 11% are opposed. But most local elected officials are fighting hard to avoid having to be honest and vote on the tax increase they impose.

75% of registered voters in Kansas support this plan and only 11% are opposed. But most local elected officials are fighting hard to avoid having to be honest and vote on the tax increase they impose.

When testimony on SB 294 was heard in the Senate Tax Committee, local officials objected to the cost and extra workload of notifying taxpayers and holding public hearings. But they never object to the extra cost and work associated with services they want to provide; in fact, voter demand if often cited as the rationale for spending more money. In this case, it’s quite clear that voters demand this new service but officials object because they don’t want to be on the record supporting the entire property tax they imposed.

Local officials also lobbied hard for exemptions from the vote requirement for increases due to inflation and from new construction. The Senate fortunately strongly defeated those efforts and unanimously passed SB 294 by a 39-0 vote. The House is now considering the bill, starting with a hearing today in the House Taxation Committee.

Local government property tax increases compared to inflation and population for the 10 most-populous counties are shown in the charts below. Complete listings for all counties, as well as reports historic changes in county mill rates, property tax, and honesty gaps are here on KansasOpenGov.org.