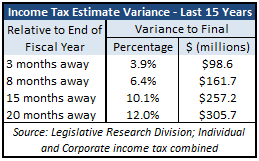

Moving the timetable for the issuance of Spring revenue estimates from April to May is among the task force recommendations to improve to the process, and history shows that to be a much-needed change. Over the last 15 years, the April income tax estimate (Individual and Corporate combined) have missed the current year actual receipts (just 3 months away from the end of the fiscal year) by an average of $98.6 million dollars. The April estimate for the following fiscal year (15 months away from the end of that year) has missed by an average of $257.2 million.

The tendency to overestimate income tax receipts is  only slightly higher; the current fiscal year was overestimated nine times and underestimated six times. The following fiscal year was overestimated eight times and underestimated seven times. Income tax receipts fluctuate significantly in the filing month of April, so it makes perfect sense to have those results in hand before issuing new revenue estimates. The timing change may require an adjustment in the Legislature’s schedule, such as beginning the session in February and concluding early in June, but having accurate information seems much more important than scheduling convenience.

only slightly higher; the current fiscal year was overestimated nine times and underestimated six times. The following fiscal year was overestimated eight times and underestimated seven times. Income tax receipts fluctuate significantly in the filing month of April, so it makes perfect sense to have those results in hand before issuing new revenue estimates. The timing change may require an adjustment in the Legislature’s schedule, such as beginning the session in February and concluding early in June, but having accurate information seems much more important than scheduling convenience.

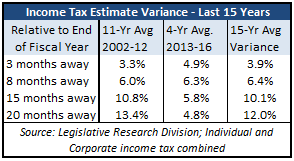

One might assume from media reports and political commentary that missing revenue estimates is a recent phenomenon caused by tax reform, but that’s not the case. Estimates made three months away have been less  accurate over the last four years, but much of that may have been related to a change in federal capital gains tax rate in 2013. Gains were taken at the lower rate in 2012 and paid in April 2013, but revenue estimators had no knowledge of how that ‘pull forward’ would impact April 2014 receipts. Estimates made eight months away varied quite similarly before and after tax reform, but long term projections have actually been much more accurate over the last four years.

accurate over the last four years, but much of that may have been related to a change in federal capital gains tax rate in 2013. Gains were taken at the lower rate in 2012 and paid in April 2013, but revenue estimators had no knowledge of how that ‘pull forward’ would impact April 2014 receipts. Estimates made eight months away varied quite similarly before and after tax reform, but long term projections have actually been much more accurate over the last four years.