Yesterday, the Kansas Senate passed SB 539, the second flat tax bill this session after an earlier bill was vetoed by Governor Kelly and failed its override. Compared to Governor Kelly’s own plan, SB 539 offers more savings to taxpayers – with low-income taxpayers having the largest percent reduction each year.

The Nuts and Bolts

Here’s how it works: in its first year, the bill sets a flat tax rate – that is, the same rate across all brackets of income – at Kansas’s top rate of 5.7%. However, this comes with the first $22,000 a family earns being exempted from taxation so there is tax relief, particularly for low-income earners. Then, for each year after, the rate drops by 0.05 percentage points until it ends up at 5.45%.

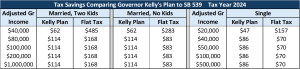

Since the flat rate of 5.7% is the same as the current top marginal rate, the savings cap out at $168 for married couples with two children and adjusted gross income above $80,000 and at $70 for individuals with AGI above $40,000. A couple with two children and $40,000 AGI will save $485 the first year, and an individual with $20,000 AGI will save $157 (both exclusive of any earned income tax credit). Each example assumes the taxpayer takes the standard deduction and doesn’t have Social Security income.

The savings for middle-income households and individual taxpayers increase significantly beginning in tax year 2025 because deductions are increased for inflation and the flat rate declines.

The amended bill that passed on Thursday included a provision completely exempting Social Security benefits from taxation and a child tax credit. Neither of these provisions affect the income tax changes above, but do increase the fiscal note on the bill – not in a way that the state can’t afford, as demonstrated later.

Everyone pays the same rate on taxable income, but exempting the first $22,000 married and $11,000 single means that the effective tax rates are still progressive. The effective tax rate is tax liability divided by adjusted gross income. The income exemption also exempts many low-income taxpayers from paying any income tax.

A couple with two children with adjusted gross income below $36,000 will not pay any income tax under 539 but they pay $589 in state income taxes under the current tax system. A single taxpayer will not pay tax on the first $15,000 of AGI, whereas they pay $287 currently (not counting an earned income credit in both cases).

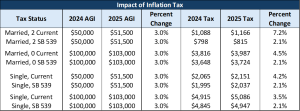

The standard deduction, personal exemptions, and dependent exemptions are indexed for inflation beginning in tax year 2025. That nearly eliminates having to pay higher taxes because of inflation.

For example, a couple with two children whose AGI increases 3% – from $50,000 to $51,500 – has the entire increase taxed at 5.25% in the current system, resulting in a 7.2% tax increase. If inflation was 3%, the couple’s purchasing power doesn’t change, but they still get a tax increase.

However, under SB 539, only $420 of the pay increase is taxable because they get higher inflation-adjusted deductions for the standard deduction, personal exemption, and the amount exempt from taxation. In this case, a 3% pay increase only results in a 2.1% tax increase, leaving the couple with a slight increase in buying power.

As demonstrated by the above examples, SB 539 offers significant savings for low and middle-income earners over time and eliminates the inflation tax in the current three-rate system.

Why a flat tax?

At first glance, a flat tax is more than justified as relief for families who have struggled through high inflation over the last several years and an increasingly depressed view towards the economy. However, a flat tax would also be cohesive to the long-term economic growth Kansas has sorely been lacking in recent memory. After corporate income taxes, individual income taxes are the second most harmful type of tax towards economic growth. Reducing the burden of a personal income tax does more to the economy than an identical cut to, say, a sales tax.

For instance, an income tax affects people’s willingness to work: the more a worker is taxed, the less they earn and can spend, and thus can be dissuaded from working more. Studies of flat taxes in Europe have found that their implementation increases the number of people working and the number of hours they work, with the most significant effects coming with tax cuts for people with lower incomes. A nationwide flat tax was estimated to increase savings by 10 to 20%.

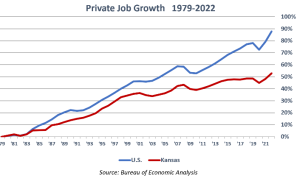

Between 2021 and 2023, 27 states enacted some form of income tax rate reductions, including every single one of Kansas’s neighbors. Some of these states, such as Idaho, Utah, North Carolina, Florida, Arizona, and Colorado, are some of the fastest growing in terms of GDP, employment, and wages in the entire country.

By comparison, Private-sector job growth in Kansas was ranked #44 between 1998 and 2022. December 2023 private-sector jobs were just 0.3% higher than the year before, which also is far below the national average. Kansas had the worst record in 2023 among bordering states on domestic migration, as more U.S. residents moved out of state than in, according to data from the U. S. Census.

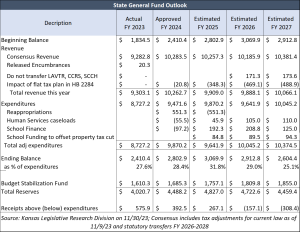

Kansas can also easily afford a flat tax. Over the last several years, the state has accumulated a significant surplus yet hasn’t given any money back to the taxpayer. The table below applies the fiscal note for SB 539 to a budget profile provided by Kansas Legislative Research Department based on HB 2284 (the billed vetoed by Gov. Kelly earlier this session), substituting the revenue impact and the expense impact of offsetting the residential property tax savings. The state will still have $4.8 billion in total reserves between the State General Fund and the Rainy Day Fund.

Kansans deserve tax relief – and SB 539 is something that provides it across all incomes at a time when the state can readily afford it. The House now has this opportunity for tax reform in their hands.