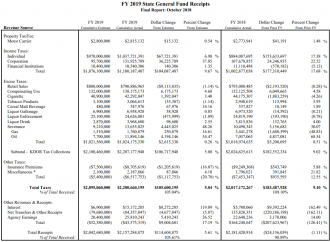

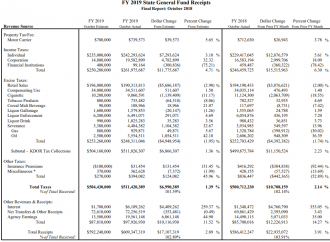

October 2018 taxes exceeded expectations for the fiscal year, tracking around 5 percentage points higher. Income tax is up and is the largest contributor to total tax collections being over estimates and last year. Sales tax is struggling again in October; the largest drag to total tax collection growth. You can see the tables below (click to enlarge).

The more money a person has, the more they are willing to spend. If income tax collections from Kansans are rising, then sales tax from them should be rising as well. Sales tax growth, absent any tax changes, is indicative of purchasing more goods and services, which is roughly 70% of GDP. However, this is the 4th straight month Kansas sales tax revenues didn’t grow above the change in prices, known as inflation. Meanwhile, retail sales at the national level has hovered around 4% since 2017 and the nation is seeing GDP growth at its highest level in years. If most other states are seeing spending gains, what’s happening in Kansas that’s keeping the state from growing with everyone else ?

The more money a person has, the more they are willing to spend. If income tax collections from Kansans are rising, then sales tax from them should be rising as well. Sales tax growth, absent any tax changes, is indicative of purchasing more goods and services, which is roughly 70% of GDP. However, this is the 4th straight month Kansas sales tax revenues didn’t grow above the change in prices, known as inflation. Meanwhile, retail sales at the national level has hovered around 4% since 2017 and the nation is seeing GDP growth at its highest level in years. If most other states are seeing spending gains, what’s happening in Kansas that’s keeping the state from growing with everyone else ?

If Kansans are giving more of their dollars to the state but not spending more dollars, then perhaps the fundamental aspects of robust economic growth are still absent in Kansas.