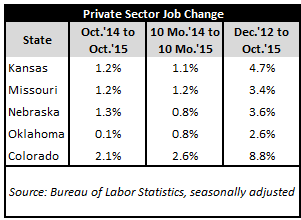

You wouldn’t know it from frequent media reports citing U.S. Bureau of Labor Statistics numbers for Kansas, but the number of private-sector jobs in the Sunflower State has actually GROWN by 4.7% in the almost three years post-tax reform in 2012. This pace trails only that of Colorado (8.8%) in the region.

You wouldn’t know it from frequent media reports citing U.S. Bureau of Labor Statistics numbers for Kansas, but the number of private-sector jobs in the Sunflower State has actually GROWN by 4.7% in the almost three years post-tax reform in 2012. This pace trails only that of Colorado (8.8%) in the region.

The 4.7% growth rate since December 2012 is the 24th best in the nation. Kansas’ job growth ranks 29th nationally when comparing states’ annual averages in private-sector jobs for 2015 to those same annual averages for 2012. By comparison, Kansas ranked 38th nationally in annual average job growth from 1998 to 2012.

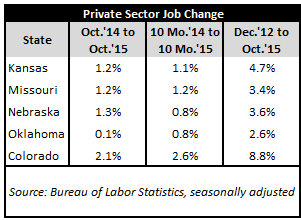

Many commentaries have tried to measure the health of Kansas’ economy by tracking changes in preliminary, month-to month estimates of how many jobs exist in the state at that single point in time. However, this approach is short-sighted because it allows short-term jobs spikes and declines within specific industries to have excessive influence in coloring the overall numbers for any state positively or negatively each month.

Take the four industries listed in the adjacent table for example.

The mining & logging industry (which includes oil and gas extraction) is an industry that affects jobs reports for Kansas and all of its regional peer states except Nebraska. Yet, the industry is one of the most highly sensitive to global supply and pricing fluctuations that have little to do with particular policy choices made in Kansas or elsewhere in the region.

The aerospace industry is also a highly global one, but it is only large enough to show up on and affect jobs reports for Kansas and Oklahoma in the region.

Transportation equipment manufacturing is a large enough industry to affect jobs reports for all states in the region but job growth within it can be tied to demand for a specific product that may be heavily produced in one or more regional states but not others.

Lastly, job growth or decline in the motor vehicle manufacturing industry only shows up on and affects jobs reports for Missouri given the industry’s small size in every other regional peer state.

Taken together, the four industries mentioned make up less than 7% of each regional state’s private-sector economy, but their collective effect on private-sector job growth reported can be seen in the differences between “total private-sector” job growth and “all other” private-sector job growth (with the four industries removed) in the table above.

The differences serve as just one illustration of how simply tracking month-to-month changes in the number of private-sector jobs within a state doesn’t tell the whole story regarding that state’s economic vitality and outlook. Longer-term examinations are far more telling…Kansas’ job growth post-tax reform teaches us that.