Most homeowners and businesses have been hammered with large property tax increases across the U.S., as many local officials have taken advantage of runaway assessed valuations over the last two or three years. The same is true in some parts of Kansas, but the Truth in Taxation / revenue-neutral law passed in 2021 is producing smaller increases in many counties.

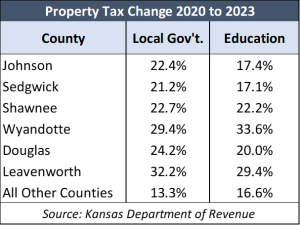

Data from the Kansas Department of Revenue and the Bureau of Labor Statistics show property tax increases for the operation of local government entities in 76 counties were at or below inflation over the last three years. The Consumer Price Index for Midwest cities increased by 17.8% between 2020 and 2023. For this purpose, local government includes everything except school districts and other educational entities.

Local government entities in the state’s six largest counties, which are becoming more politically progressive and spending a lot more, increased property taxes considerably more than inflation. Among those, Leavenworth County has the largest tax increase at 32.2%, followed by Wyandotte County at 29.4%.

Local government entities in the state’s six largest counties, which are becoming more politically progressive and spending a lot more, increased property taxes considerably more than inflation. Among those, Leavenworth County has the largest tax increase at 32.2%, followed by Wyandotte County at 29.4%.

The increases for the operation of education entities are at or below inflation in 72 of the state’s 105 counties. Education property tax increased slightly less than inflation in Johnson and Sedgwick counties but exceeded inflation in the other four largest counties, with Wyandotte (33.6%) and Leavenworth (29.4%) jumping the most. Education property tax in all other counties combined was a little below inflation, at 16.6%.

Property tax collected for the operation of local government entities declined over the last three years in six counties – Cherokee, Cheyenne, Clark, Hamilton, Neosho, and Ottawa; the increase averaged less than 2% each year in 21 counties. Education property taxes declined in four counties – Commanche, Hamilton, Phillips, and Wallace – and 13 other counties saw education property taxes increase less than 2% per year.

The three-year changes for each county are here, and the change for 2023 is at KansasOpenGov.org.

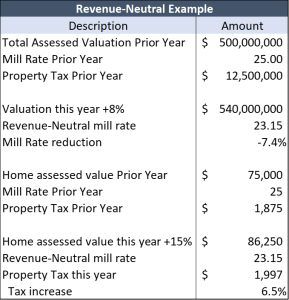

Beginning in 2021, the revenue-neutral law reduces each taxing authority’s mill rate each year so that the new valuations generate the same dollar amount of property tax from the prior year. Local officials who want to exceed the revenue-neutral mill rate must give taxpayers written notice of their intent, hold a public hearing on the proposal, and then take a recorded vote on the entire tax increase they impose.

There is no limit on increases, but officials must be honest about the tax increase, and that has prompted many taxing authorities to not raise property taxes by keeping the revenue-neutral rate. Also, some entities that increase taxes are doing so by smaller amounts.

Skyrocketing appraisals still hurt homeowners

Revenue-neutral measures the impact on taxing authorities. A city or county may take in the same total tax dollars as the year prior, but homeowners hit with large assessed valuation increases will still pay more.

For example, a hypothetical city with $500 million in total assessed valuation and a mill rate of 25 would collect $12.5 million in property tax (one mill equals $1 of property tax for each $1,000 of valuation). If valuations increase by 8% next year and the city chooses to remain revenue-neutral, its mill rate drops to 23.15 to produce $12.5 million in property tax.

For example, a hypothetical city with $500 million in total assessed valuation and a mill rate of 25 would collect $12.5 million in property tax (one mill equals $1 of property tax for each $1,000 of valuation). If valuations increase by 8% next year and the city chooses to remain revenue-neutral, its mill rate drops to 23.15 to produce $12.5 million in property tax.

A homeowner whose valuation increased 15%, however, would get a 6.5% tax increase at the revenue-neutral rate of 23.15.

This is, unfortunately, happening to many homeowners as many county appraisers imposed double-digit valuation hikes on existing homes in 2022 and 2023. This report on KansasOpenGov shows the increase for each county since 2013; valuation changes on existing property factors out changes due to new construction.

Two constitutional amendments to restrict residential valuation increases are being considered by the Legislature. Last year, the Senate passed SCR 1610, which would generally limit valuation increases to 3% per year; the bill had a hearing in the House Taxation Committee this year, but it has not been brought up for a vote. The House Taxation Committee also held a hearing on HCR 5025, which would set residential valuations based on the average fair market value of each parcel over the last ten years.

Other options, not yet introduced, would place a hard limit on the tax increase that any jurisdiction can impose or require a public vote to exceed a specified threshold.