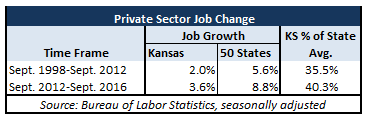

Kansas has a long history of trailing 50-state average job growth, but—as the adjacent table shows—it has become gradually more competitive in the four years since 2012 than it was in the fourteen years prior to 2012. Private sector jobs grew almost twice as fast over the last four years (3.6 percent vs 2.0) and are growing at 40.3% of the fifty-state average compared to 35.5% prior to tax reform.

Comparisons to neighboring states may seem intuitive, but—just as neighboring school districts often have dramatically different demographic mixes—components of state economies also vary greatly. Kansas, for example, is more dependent upon aerospace, farming, and natural resource extraction, so fluctuations in global demand or weather can disproportionately impact a state’s overall average.

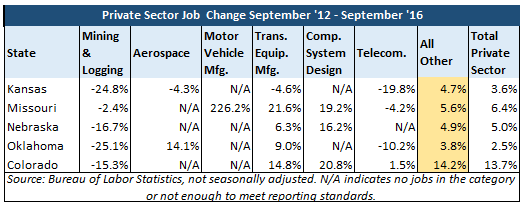

Isolating growth in six nationally and globally-driven industries from “All Other” industries shows Kansas and Oklahoma each performing more than a full percentage point better than they do when looking at their “Total Private Sector” job growth. What’s more, the “All Other” industries group still comprises anywhere from 92% to 97% of each regional state’s private-sector economy, which speaks to the outsized influence of the six industries we chose to isolate.

Mining and logging is a natural choice for isolation given that it includes oil and gas extraction, a highly global sector. Kansas is much more reliant on these commodities than its regional peers are, so global developments within the sector will have a greater impact on jobs numbers reported for Kansas despite having almost nothing to do with state policy developments in Kansas.

A similar dynamic arises when considering the telecommunications industry. The industry is also highly global, but Kansas’ jobs numbers are disproportionately affected by its fluctuations because Kansas is home to the Sprint Corporation.

The motor vehicle manufacturing industry factors into jobs numbers reported for Missouri but isn’t large enough to be a factor elsewhere in the region. Similarly, the aerospace industry is only prevalent regionally in Kansas and Oklahoma.

Finally, job growth in the transportation equipment manufacturing and computer systems design industries can be driven by demand for products produced almost exclusively in one or more regional states but not others.

Overall, the industry examples above show why monthly changes in BLS jobs numbers are unreliable indicators of a state’s true economic vitality. Stay tuned for our forthcoming research in collaboration with Arizona State University, which will offer a better way to assess job growth in Kansas post-tax reform.