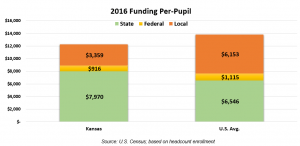

U.S. Census data shows Kansas had the 16th highest state school funding per-pupil in 2016 at $7,970, based on headcount enrollment and total state aid of $3.9 billion. Legislators therefore provided state aid that was 22 percent above the national average of $6,546 back in 2016 and KSDE estimates state aid will be $4.5 billion this year, so state aid could now be ranked inside the top ten since it exceeds $9,000 per-pupil.

Local funding per-pupil, however, was 45 percent below the national average at just $3,359 and ranked #44 in the United States. The national average in 2016 was $6,153 per-pupil.

Should the Kansas Supreme Court reject the Legislature’s latest attempt to create adequate funding, this extraordinary disparity between the rankings of state and local aid may present a creative way to appease the Court without breaking the state budget by putting the onus on local school boards to increase property taxes if they believe they are underfunded.

Should the Kansas Supreme Court reject the Legislature’s latest attempt to create adequate funding, this extraordinary disparity between the rankings of state and local aid may present a creative way to appease the Court without breaking the state budget by putting the onus on local school boards to increase property taxes if they believe they are underfunded.

To be clear, we’re not suggesting that funding or property taxes should be increased. KPI has written extensively showing that courts have no authority to order funding increases and that spending more money does not cause achievement to improve. The appropriate legislative response would be to ignore the court as it has no authority to dictate legislative action. But if they are determined to do something, legislators could at least make it clear that any tax increases are by choice of local school boards.

Here’s one way it could work:

- Roll back some or all the increases to BASE aid (formerly known as Base State Aid). Many legislators acknowledge that court-forced school funding increases are largely to blame for more than a $1 billion shortfall over the next four years despite record-setting tax collections.

- Grant districts additional Local Option Budget (LOB) authority that can only be accessed if (a) the local school board certifies that sufficient funds have been allocated to Instruction to allow students to meet required outcomes and (b) that the additional LOB authority is incremental to existing Instruction expenditures of the district.

- Make statutory provision instructing courts to interpret a district’s choosing to not access the additional LOB authority as evidence the district believes it is already adequately funded.

It’s time to stop pretending that school funding can continuously be increased without forcing tax increases. At least this way, local school boards and administrators would have to take direct responsibility for their actions.