Imagine how your property tax bill would look if cities and counties were only permitted to increases taxes by inflation unless voters said taxes could go higher. It’s not a fantasy; legislation pending in Topeka could make that happen shortly.

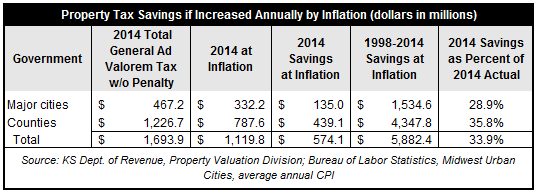

Had such a law been in place since 1998, property taxes levied by the 25 largest cities would have been $135 million lower last year and county property taxes (not including cities, schools, etc.) would have been $574 million lower. That would equate to an average reduction of 29 percent for major cities and 36 percent for counties. The savings over the entire period would have been $1.535 billion for taxpayers in those cities and $4.348 billion for county taxpayers; combined savings would have been $5.882 billion if citizens had not allowed taxes to increase beyond the rate of inflation. A list of those cities and all 105 counties is available here.

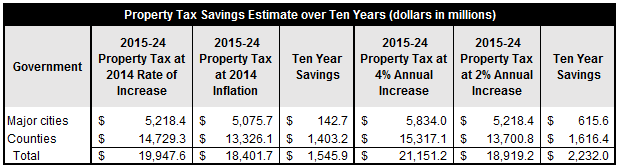

Your property tax won’t be reduced if this legislation passes but we can estimate what it would be worth going forward. The change in the annual Consumer Price Index for Midwest Urban Cities was 1.5 percent last year. Those 25 cities increased taxes by 2.0 percent last year and the average county increase was 3.3 percent. If we assume that cities and counties would continue to increase at those rates without your permission over the next ten years and inflation continues at 1.5 percent, the proposed legislation would result in total city and count savings of $1.546 billion (assuming citizens voted to hold property tax increases at inflation). If we assume cities and counties would all increase by 4.0 percent and inflation is 2.0 percent, the combined savings would be $2.232 billion.

Stay tuned.