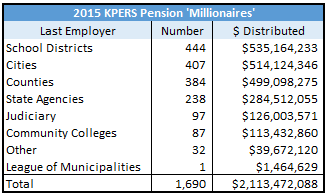

Pension payment data collected from the Kansas Public Employee Retirement System (KPERS) in an Open Records request includes 1,690  state and local government retirees who will collect more than $1 million in taxpayer-funded pension payments over their first 20 years of retirement. The number of taxpayer-funded pension ‘millionaires’ is up by 213 from last year’s total of 1,477 ‘millionaires.’

state and local government retirees who will collect more than $1 million in taxpayer-funded pension payments over their first 20 years of retirement. The number of taxpayer-funded pension ‘millionaires’ is up by 213 from last year’s total of 1,477 ‘millionaires.’

Local government (schools, cities, counties and some of the “Other’ group) dominates the pension ‘millionaires’ list. Among various employer categories, local School districts have the most pension ‘millionaires’ (444 out of 1,690) —followed by cities (407) and counties (384) respectively.

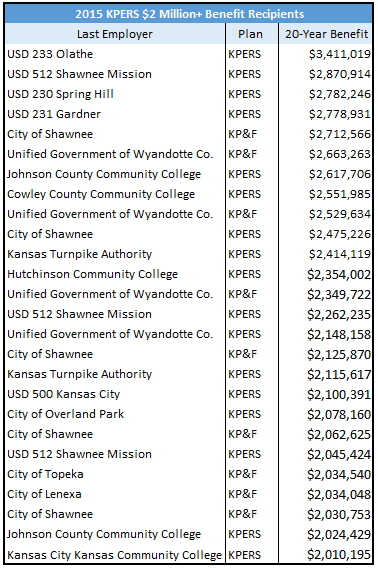

Twenty-six retirees will collect more than $2 million over their first twenty years of retirement. Retirees can elect to take a one-time lump sum payment upon retirement and receive reduced annual payments thereafter. KPERS retirees receive benefits for life, and those payments are exempt from state income taxes—although retirees did pay income tax on their personal contributions to the plan. Employer contributions and the earnings on all contributions are never subject to state income tax.

It should be noted that those saying it is unfair to exempt limited liability corporations (LLCs)  and the listing of and other small businesses from paying income taxes on non-wage “pass through” income have been unwilling to entertain changing the preferential tax treatment given to government employees. Exempting pass-through income from taxation raises legitimate questions of fairness, but true discussions of fairness must also ask whether it is also fair for public employees to enjoy their retirement benefits tax-free while private-sector retirees pay taxes on their pensions and 401(k) plans.

and the listing of and other small businesses from paying income taxes on non-wage “pass through” income have been unwilling to entertain changing the preferential tax treatment given to government employees. Exempting pass-through income from taxation raises legitimate questions of fairness, but true discussions of fairness must also ask whether it is also fair for public employees to enjoy their retirement benefits tax-free while private-sector retirees pay taxes on their pensions and 401(k) plans.

The full list of pension ‘millionaires’ and all KPERS’ recipients for 2015 are available at KansasOpenGov.org.