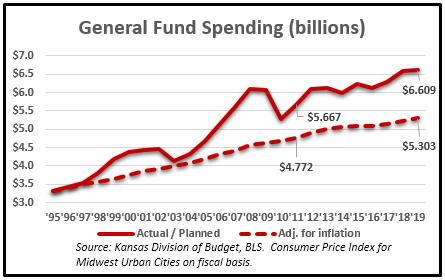

Unless legislators change their tax-and-spending-spree ways, Kansans have another big tax increase coming in the near future. The nearly $500 million spending increase just approved for fiscal years 2017 through 2019 pushes General Fund spending to $6.609 billion; that’s $1.3 billion more than if spending had just been increased for inflation since FY 1995.

Kansas Legislative Research Department says the budget will be out of balance within two years even after accounting for the largest tax hike in state history, and deficits could explode if the Supreme Court orders hundreds of millions more in school funding and/or legislators expand Medicaid as many say they intend to do next year.

Kansas Legislative Research Department says the budget will be out of balance within two years even after accounting for the largest tax hike in state history, and deficits could explode if the Supreme Court orders hundreds of millions more in school funding and/or legislators expand Medicaid as many say they intend to do next year.

Forcing government to eliminate waste is the only real option to avoid another big tax increase and while some legislators say they believe in efficient government, most of them have been unwilling to do so. Former Speaker of the House Mike O’Neal says, “Politicians love to give out candy to everyone” and economist Thomas Sowell explains their motivations: “No one will really understand politics until they understand that politicians are not trying to solve our problems. They are trying to solve their own problems — of which getting elected and re-elected are No. 1 and No. 2. Whatever is No. 3 is far behind.”

Some legislators say spending can’t be reduced and some of them may believe that because they aren’t given the information they need to understand how money is wasted. The new Performance Based Budgeting system, however, will show dozens of ways to provide the same or better quality service at better prices if (1) legislators and the governor prevent the bureaucracy from subverting the process and (2) legislators act on the opportunities uncovered.

You can’t change politicians’ motivation but you can use it to your advantage. They give candy to special interests because they believe that’s the best way to achieve Sowell’s Priorities #1 and #2; citizens need to demonstrate that tax-and-spend will lead to their ouster – and you can start by asking two simple questions:

- What actions are you taking to ensure that state agencies are fully cooperating with the State Budget Director to honestly implement Performance Based Budgeting?

- Will you support every opportunity to reduce costs without sacrificing quality?

By the way, Kansas spent 27 percent more per-resident providing the same basket of services as states without an income tax, and that was before the most recent spending spree.

If you want efficient spending instead of another big tax increase and you don’t make your wishes crystal clear to your Representative and Senator, you’re effectively giving them permission to stick you with another big tax increase in the near future. We hear it all the time…’well, I’m only hearing from people who support a tax increase.’

Whether the future holds another big tax hike or more efficient government is really up to you.