Articles Filtered By:

Tax & Spending Research

2021 Legislator Briefing Book

January 14, 2021A Kansas Budget for Economic Growth & COVID Protection

January 4, 2021

STAR Bonds redirect jobs, not create them

August 28, 2020County Budgets Review: Bringing Savings to Families

August 6, 2020Kansas #26 in “Rich States, Poor States”

April 29, 20182018 Green Book: Smaller government, more growth

April 22, 2018Are you ready for another tax increase?

September 11, 2017IRS data refutes Kansas tax evasion theories

May 17, 2017States that Spend Less, Tax Less…and Grow More

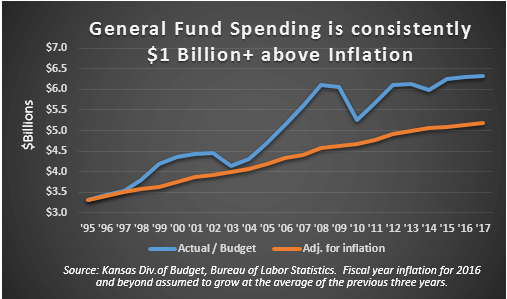

April 7, 2017Kansas budget can be balanced without tax hikes

February 28, 2017Efficient, Effective Spending Keeps Taxes Low

February 26, 2017Kansas tax proposal endorses government favoritism

January 20, 2017Coverage of proposed $820 million tax hike loaded with media bias

December 27, 2016$820 million tax hike not necessary

December 11, 2016Legislative leadership moving Left in Kansas

December 6, 2016Government’s Entitlement Mentality – Part 2

November 29, 2016Government’s entitlement mentality – Part 1

November 28, 2016Oil, farming suppress sales tax collections

November 15, 2016

2016 Green Book

March 7, 2016

Houston, we have a spending problem

February 20, 2016Scare tactics and false choices: just another Tuesday at KCEG

February 17, 2016

Steve Anderson on Healing the Kansas Budget

February 11, 2015

County Property Tax and Population Comparison 1997-2014

January 1, 2015

Carve Outs For The Few? Or, Lower Taxes For The Many?

November 25, 2014

2014 Greenbook

October 29, 2014

KPI Analysis – 5 Year Kansas Budget Plan

September 1, 2014

KPI Paper – A Legislators Budget Guide

July 1, 2014

A Legislator’s Guide to Delivering Better Service at a Better Price

February 20, 2013

Tax Reform Gears Kansas for Growth

July 1, 2012Major Structural Deficits Looming in Kansas

December 1, 2011