Remember this fairy tale about Obamacare? “If you like your health care plan, you can keep it.” The Kansas version of that hollow promise is ‘we can massively increase school funding without a tax increase.’

The harsh reality is that Kansas taxpayers are being set up for a $3.7 billion tax increase over the next four years unless the majority of elected officials muster the backbone to reduce costs and stop taking orders from a runaway judiciary. That’s what it would take to have a structurally balanced budget, with each year’s spending not exceeding that year’s tax collections. (Remember? That was the war cry / ‘vote-for-me’ promise of so many people who opposed tax cuts…and then forgot about having a structurally-balanced budget when they approved massive school spending increases.)

The calculation is produced by Kansas Legislative Research Department (KLRD) and presents an honest long term picture of the tax revenue needed to pay for the increased school funding. It’s based on having a legally-required ending balance[i] without transfers from the highway fund and making all scheduled KPERS pension payments through FY 2023. The only spending increases included are those related to approved school funding, the Department of Education’s (KSDE) calculation of complying with the latest Supreme Court ruling and KLRD’s case load estimate for existing Medicaid coverage.

About $624 million of the tax increase is already in place, noted as ‘Federal Tax Adjustment’ in the above table. Federal tax reform eliminates personal exemptions, caps itemized deductions for some people and imposes higher taxes on many businesses. The Kansas Senate voted to prevent this backdoor state income tax hike but too many House members wanted more money to spend.

About $624 million of the tax increase is already in place, noted as ‘Federal Tax Adjustment’ in the above table. Federal tax reform eliminates personal exemptions, caps itemized deductions for some people and imposes higher taxes on many businesses. The Kansas Senate voted to prevent this backdoor state income tax hike but too many House members wanted more money to spend.

Paying for approved school funding without gimmicks (transfers, KPERS delays, ignoring the ending balance law, etc.) will cost another $2.1 billion and if elected officials decide to meet KSDE’s $365 million estimate of the latest court demand, another $940 million tax hike will be needed.

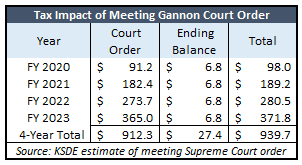

The tax impact of paying for the new school funding is much greater than the simple total of the funding  approved because of the cumulative impact of adding more money each year. The estimate of meeting the court’s latest demand is a good example.

approved because of the cumulative impact of adding more money each year. The estimate of meeting the court’s latest demand is a good example.

KSDE says funding would have to increase a little over $91 million each year and would, therefore, be $365 million higher in the fourth year; but that amounts to $912.3 million more being spent over the four-year period.

To top it off, another $27.4 million is needed to meet the higher ending balance requirement (7.5 percent of the new money added each year), bringing the total tax revenue needed over four years to $939.7 million.

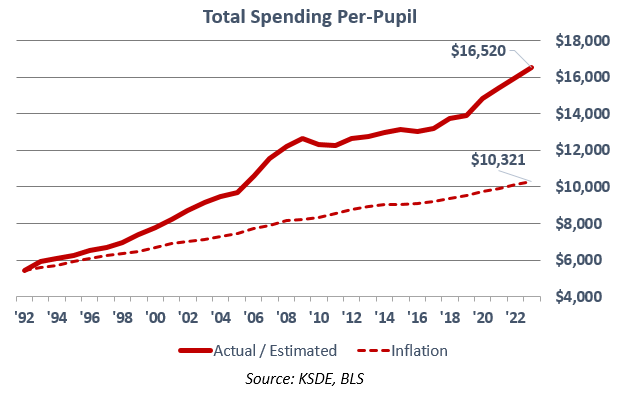

KSDE calculates the total amount approved thus far for FY 2018 through FY 2023 at just over $1 billion dollars. Total aid as calculated by KSDE would slightly exceed $8 billion in FY 2023 even if federal aid remains flat and local revenue is only nominally increased. If legislators provide the additional aid KSDE says is needed to satisfy the court with enrollment increases as KSDE anticipates, per-pupil funding would be $16,520 in FY 2023.

Those claiming school funding can be massively increased without raising taxes either don’t want you to know the implications for highways, social services and higher education, or they’re afraid to tell the truth about tax increases. Because, you know, getting elected is what really matters.

Those claiming school funding can be massively increased without raising taxes either don’t want you to know the implications for highways, social services and higher education, or they’re afraid to tell the truth about tax increases. Because, you know, getting elected is what really matters.

__________________

[i] State law requires an ending balance equal to 7.5 percent of expenditures. Legislators and governors have often ignored that legal requirement over the last couple of decades by periodically changing the law to effectively say, ‘except this year.’