Property tax history for twelve more cities added to KansasOpenGov.org underscores why so many citizens are upset with property tax hikes. On average, those dozen cites increased property tax 2.6 times faster than the combined rates of inflation and population between 1997 and 2016.

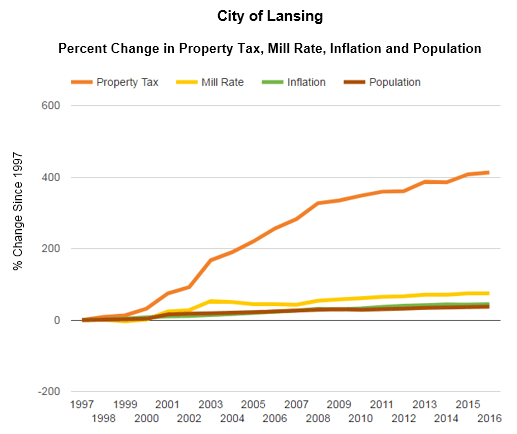

The City of Andover had the highest tax increase at 510 percent but the City of Lansing had the most egregious gap, with property taxes increasing at 5 times the combined rates of inflation and population (413 percent vs. 82 percent).

The City of Hays had the narrowest gap, with property taxes increasing 66 percent, compared to a 56 percent increase in inflation and population.

The City of Hays had the narrowest gap, with property taxes increasing 66 percent, compared to a 56 percent increase in inflation and population.

Other cities newly added include Arkansas City, Derby, El Dorado, Gardner, Great Bend, McPherson, Merriam, Ottawa and Winfield.

Graphs comparing historical changes in property tax, inflation, population and mill rates are available here for 37 cities in Kansas. The same information for all 105 counties can be found here; county data is just for the individual county and does not include other taxing jurisdictions like cities and school districts.

A property tax lid passed last year will allow Kansans to begin voting later this year on whether, with many exceptions, city and county property taxes should increase by more than the rate of inflation. Citizens overwhelming support the right to vote but local government doesn’t want citizens meddling in their business. Cities and counties are asking legislators to strip citizens of their right to vote in the current legislative session, and some are threatening residents with service cuts if they don’t get their way.