It’s not access to oil or tourism that allows some states to do without an income tax; it’s efficient, effective spending. Texas could have all the oil in the nation and still have a high tax burden if it spent a lot more.

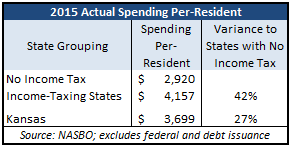

Data from the National Association of State

Budget Officers (NASBO) shows that in 2015, the states that tax income spent 42 percent more per-resident than the states without an income tax. Kansas spent 27 percent more per-resident. The data includes all state spending except for federal pass-through and spending related to debt issuance.

Efficient, effective spending is not a matter of population or land mass. New Hampshire and Nevada, for example, are much smaller in land mass and also have less population than Texas, but they still spend less per-resident. Kansas has less land mass (82,000 square miles) than Nevada (110,000 square miles) and virtually the same population, yet Kansas spends 38 percent more per-resident.

Alaska and Wyoming have very large footprints (663,000 and 98,000 square miles, respectively) and very small populations (738,000 and 586,000) which likely account for some of their outlier status, but not all.

Alaska and Wyoming have very large footprints (663,000 and 98,000 square miles, respectively) and very small populations (738,000 and 586,000) which likely account for some of their outlier status, but not all.

Wyoming has 25 percent more land mass and 32 percent less population than South Dakota, yet spends more than 4 times as much per-resident. Some of that variance is determined by spending choices of the Wyoming Legislature.

Effective is certainly a subjective term but citizens seem to find good value in the services provided by states without an income tax. Between 2000 and 2015, the states that without an income tax had positive domestic migration equal to 7 percent of their 2015 population; states that tax income had negative domestic migration, losing population equal to 2 percent of their 2015 population. Alaska was the only state of those without an income tax that didn’t have positive domestic migration.

Efficient, effective spending prevents citizens from having to choose between bad and worse (higher taxes or service cuts). That’s the key to having good quality services and low taxes, and it’s also the best path forward for all Kansans to achieve prosperity.