Ever since Kansas exempted pass-through income from state income tax beginning in 2013, media and policy analysts declared that doing so created a massive wave of Kansas tax evasion by businesses converting to an LLC or a sub-S corporation. Even the Tax Foundation jumped on the bandwagon, saying “When the exemption was passed in 2012, it was projected that 191,000 entities would take advantage of the provision. As more and more people have realized the very sizeable tax advantage of being a pass-through entity in Kansas, that number ended up being 330,000 claimants, over 70 percent more than was anticipated.”

Tax return data from the Internal Revenue Service refutes those claims, however.  According to KDOR Chief Economist Michael Austin, ” In 2011, when the tax policy was estimated, KDOR referred to Federally-held IRS data. The most recent dataset available at the time was for tax year 2009 and it had three categories of returns that would be considered as tied to a personal business; “Business or Profession Net Income”, “Number of Farm Returns”, and “Partnership/S-Corp Net Income”. The sum of these three business returns resulted in an estimate of 330,000 filers that would be impacted by the tax policy.”

According to KDOR Chief Economist Michael Austin, ” In 2011, when the tax policy was estimated, KDOR referred to Federally-held IRS data. The most recent dataset available at the time was for tax year 2009 and it had three categories of returns that would be considered as tied to a personal business; “Business or Profession Net Income”, “Number of Farm Returns”, and “Partnership/S-Corp Net Income”. The sum of these three business returns resulted in an estimate of 330,000 filers that would be impacted by the tax policy.”

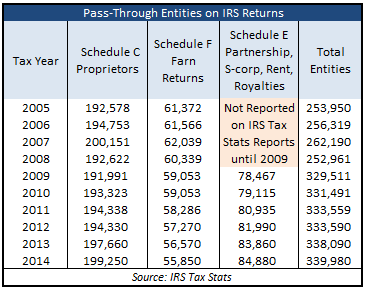

There were 191,991 Schedule C proprietors in 2009, which is very close to the number of entities used in legislative and media discussions but including farm returns from Schedule F and other entities from Schedule E, Kansas actually had 329,511 total pass-through entities in 2009.

The IRS data clearly refutes the notion that the pass-through exemption led to massive Kansas tax evasion from businesses and individuals changing their tax status. Schedule C shows just a 1.7 percent increase in the number of proprietors and there was a 2.3 percent bump in partnerships and sub-S corporations on Schedule E. The changes in 2013 and 2014 are consistent with KDOR records on C-corporation conversions to LLCs (partnerships) or sub-S corporations. How much of the Schedule C increase is due to organic growth in new proprietors or some W2 earners converting to self-employment status is unknown, but any such conversion would be minimal.