Kansans are finally climbing out of the COVID-19 economic hole, but headwinds remain due to the ongoing pandemic and government lockdowns. On the one hand, the state is gaining private jobs since April, but has 65,000 fewer private jobs than in June 2019. To make matters worse, Kansas is among the worst of neighbor states and no lockdown states in getting the unemployed back to work.

The adjacent chart illustrates the headwinds Kansans face in getting back to work and providing for their families. Also, it’s important to mention that this employment-population share includes government jobs. A private sector breakdown of the employment-population ratio isn’t available. However, this ratio is still helpful as state government jobs have remained relatively unchanged during the economic hit. In other words, changes in the private employment drive changes in the employment ratio. When Governor Kelly placed Kansas on lockdown, the state’s employed population fell to 92% of January levels. In other words, 92% of the January-level Kansas working population had a job in April. By June, the employment-population ratio rose to 95% of January levels.

If this trend continues, Kansas will not return to pre-COVID levels (100%) until October at the earliest. The Kansas lockdown may not have had an initial impact on business decisions. Many firms closed up or cut back before government intervention. However, evidence suggests lockdowns played a role in keeping businesses closed and Kansans at home unemployed longer than necessary.

From the same report, we pulled the number of Kansans who have filed for, and are receiving, unemployment benefits (continued claims). We pulled claims from Kansas, its neighbor states, and no-lockdown states to discover which is close to their pre-COVID-19 levels. Then we calculated the average of the four most recent weeks ending July 11th, the average during the first quarter of 2020, and then took it’s ratio. To interpret the ratio, unemployed Kansans drawing payments are roughly seven times higher than a typical 1st quarter week . By itself, such a figure is in line with recessionary expectations. However, when compared to neighbors and peer states, no-lockdown states seem economically healthier. Compared to most no-lockdown states, Kansas hasn’t reduced their unemployment payouts.

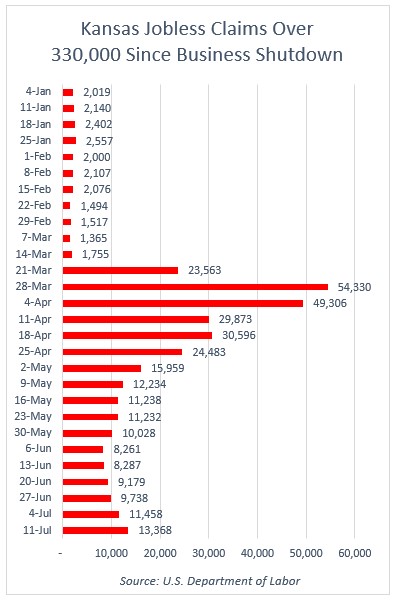

Perhaps a closer look at unemployed claimants can explain what’s the matter with Kansas. Before businesses closed in the 3rd week of March, about 20,000 Kansans filed an initial unemployment claim in 2020. Since then, total unemployment claims since businesses shutdown is over 330,000. In fact, since early June, initial claims are trending in the wrong direction. Kansas is seeing growth in unemployment filings since May.

Perhaps a closer look at unemployed claimants can explain what’s the matter with Kansas. Before businesses closed in the 3rd week of March, about 20,000 Kansans filed an initial unemployment claim in 2020. Since then, total unemployment claims since businesses shutdown is over 330,000. In fact, since early June, initial claims are trending in the wrong direction. Kansas is seeing growth in unemployment filings since May.

Government lockdowns created persistent harm in the Kansas economy with the depth and permanence of that harm being unknown at this point. According to a survey done by economic professors at Harvard, University of Chicago, and the University of Illinois, the national median small businesses have more than $10,000 in monthly expenses but less than one month of cash on hand. Moreover, a KPI survey of small businesses conducted by the Gwartney Institute and the National Federation of Independent Businesses found that 40% of Kansas businesses don’t believe they will return to pre-COVID operations this year. Also, nearly 3/4ths of Kansas businesses considered the state lockdown “too restrictive,” despite most respondents deemed “essential”. Considering Kansas small businesses employ most Kansas workers, it shouldn’t come as a surprise the initial lockdown was an economically costly endeavor. Any further consideration of an economic shutdown must take into account the economic costs along with COVID health metrics.

A prudent, safe return to work means policies that encourage more hiring and opportunity for Kansas families. We outlined such policies in our 40-point COVID recovery plan or our small business COVID survey. The last thing Kansans need is a focus on protecting bloated government budgets at the expense of Kansas family and businesses. A tax increase to close the impending $1.5 billion shortfall just when small businesses are trying to recover will only put Kansas farther behind states that chose opportunity and freedom.