Yesterday, Governor Laura Kelly vetoed HB 2036, a tax reform bill that would save Kansas $636.7 billion in its first year of FY 2025. It would then save between $458.9 and $468.7 million annually from FY 2026 to FY 2029. The bill is the latest culmination of the back-and-forth throughout the legislative session. Despite it being sent to the Governor’s desk with a 119-0 vote in the House and 24-9 in the Senate, Kelly wavered then eventually delivered a veto.

KPI did a thorough breakdown last week of Kelly’s various claims towards the bill and why none of them hold up. The reasoning accompanying today’s veto was largely the same. With her veto, Gov. Kelly proposes doing $433 million per year in tax relief instead of the approximate $460 million that HB 2036 would cost. That $30 million difference is about one-third of a percent of Kansas’s entire $10 billion budget. As of this writing, her new “plan” only includes a few bullet points and little of substance.

Gov. Kelly’s latest proposal not only comes out at a lesser price tag, but also includes a child tax care credit that would cost around $90 million dollars annually. That would mean a reduction in HB 2036’s current policies – most likely the $230 million towards an income tax reduction. Having a $140 million income tax reduction is more than nothing, but incredibly small benefits equal to the slightest of shaves off existing tax brackets.

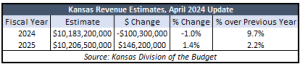

The $460 million estimate for HB 2036 comes from the Kansas Consensus Revenue Estimating Group’s April update to the budget forecast from last Friday and updates forecasts from November of 2023.

The changes in revenue estimates were minimal: FY 2024’s estimates decreased by $100.3 million below the November estimates. Against the $10.2 billion budget, this decrease was around 1.0%. FY 2024, with the new update, will still be 9.7% more than FY 2023’s confirmed revenue receipts – that’s a $900 million increase. FY 2023 was already 17.3% greater revenues than the year before it too.

The FY 2025 estimate was increased slightly by $146.2 million, which is 1.4% higher than the last estimate.

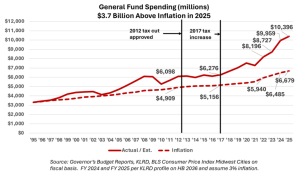

The story here is in the lack of substantive changes in the revenue estimates. For instance, in April 2017, the Consensus Revenue Estimating Group had an 8% decrease in their FY 2018 revenue estimates. After a $3 billion tax hike in June of that year, the FY 2018 estimates were up 7.5% in November. This was part of the long fallout of Governor Brownback’s failed tax reform, which included both real issues from not balancing spending with revenue cuts and inaccurate revenue estimates.

This means that Kansas can afford HB 2036 that Gov. Kelly just vetoed. In November 2023, the Kansas Legislative Research Department that Kansas would end FY 2028 with $2.7 billion in its ending balance and $1.8 billion in the Budget Stabilization Fund. This was with SB 169 – last year’s failed flat tax proposal that is slightly largely in scale than HB 2036 – built into the estimates.

With the minimal changes to the state’s revenue estimates, the massive glut of taxpayer cash that the state has accumulated from high revenue collections remains. With her veto, Kelly is literally squabbling over minor concerns, and as a result, preventing tax relief for everybody. As evidenced by the unanimous House passage of HB 2036 originally, even members of Kelly’s own party see that her budget concerns don’t hold up.

Why HB 2036?

A flat tax would have also been conducive to the long-term economic growth Kansas has sorely been lacking in recent memory. After corporate income taxes, individual income taxes are the second most harmful type of tax towards economic growth. Between 2021 and 2023, 27 states enacted some form of income tax rate reductions, including every single one of Kansas’s neighbors. Some of these states, such as Idaho, Utah, North Carolina, Florida, Arizona, and Colorado, are some of the fastest growing in terms of GDP, employment, and wages in the entire country.

According to a recent paper by KPI and the Buckeye Institute of Ohio, Kansas would have $390 million in economy growth and $220 million in business investment in the first year of a tax cut similar to last year’s vetoed SB 169 flat tax bill.

Kansas hasn’t been one of these states, and taxpayers haven’t received significant tax relief through a pandemic, high inflation, and now a new uncertainty towards the economy and world today. Though smaller than the flat tax bill that open legislative negotiations on taxes, HB 2036 is a bill that puts trust in Kansas families to make the right decision with their money instead of the government. Given the affordability of HB 2036 and the incredibly minor reasons for her veto, Gov. Kelly’s “middle-of-the-road” rhetoric falls apart with her choices.