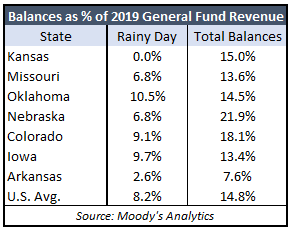

The state budgets of Kansas and Missouri are among the worst-prepared states in the nation, according to an April 9 report from Moody’s Analytics. The main reason is that both states are below the national average in rainy-day balances as a percentage of fiscal 2019 general fund revenues.

According to Moody’s, Kansas and Illinois are the only two states that don’t have a ‘rainy-day’ fund balance – money that is expressly set aside to deal with emergencies. The U.S. average is 8.2% of 2019 general fund revenues. Kansas had 15% of 2019 general fund revenues in its General Fund ending balance, so the state’s total balances are 15% of revenue. Missouri’s total balance is 13.6% of revenue.

According to Moody’s, Kansas and Illinois are the only two states that don’t have a ‘rainy-day’ fund balance – money that is expressly set aside to deal with emergencies. The U.S. average is 8.2% of 2019 general fund revenues. Kansas had 15% of 2019 general fund revenues in its General Fund ending balance, so the state’s total balances are 15% of revenue. Missouri’s total balance is 13.6% of revenue.

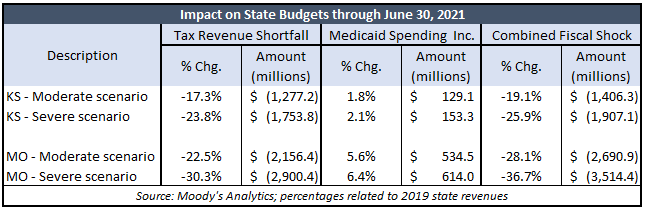

Unfortunately, Moody’s predicts the total COVID fiscal shock to be between 19.1% and 25.9% of Kansas’ general fund revenue through fiscal year 2021. Their estimate for Missouri is between 28.1% and 36.7% of 2019 revenue for Missouri.

Impact on the Kansas budget

The Moody’s report puts the combined fiscal shock under their moderate stress scenario at $1.406 billion; that’s the combined impact of a $1.277 billion decline in revenue and a $129.1 million increase in Medicaid spending (related to the unemployed qualifying for Medicaid). Their severe stress scenario predicts a combined fiscal shock of $1.907 billion (a $1.754 billion decline in revenue and $153 million more spent on Medicaid).

Kansas Legislative Research Division in March estimated a $730.9 million General Fund ending balance for the end of Fiscal 2021. That means legislators may have to deal with a budget shortfall next year ranging from $675 million to $1.2 billion, leaving nothing in reserve at the end of the year.

Of course, there would also be severe budget deficits in FY 2022 if the COVID impact extends beyond one year. That becomes increasingly likely the longer that government-mandated lockdowns remain in place.

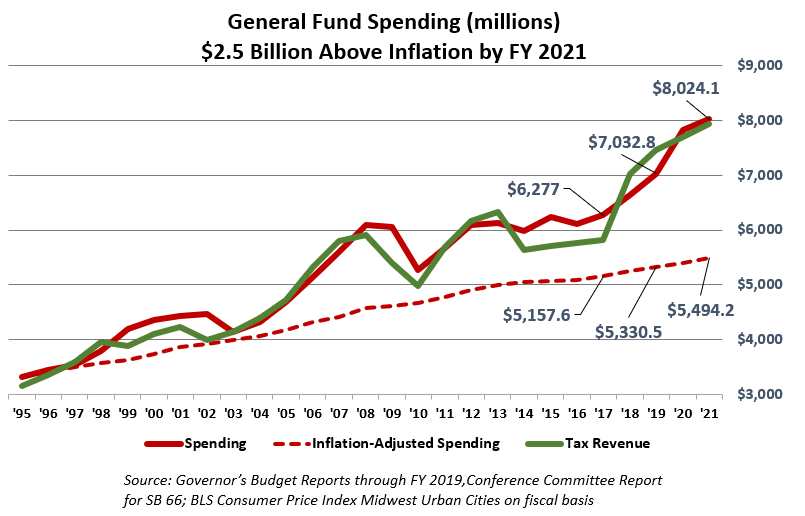

The good news is that Kansas has lots of opportunities to reduce unnecessary spending.

Every state provides the same basic basket of services, but some of them do so much more efficiently than others. The states that spend less are thereby able to tax less.

Data from the National Association of State Budget Officers show that the states with an income tax spent a whopping 55% more per resident in 2018 than the states without an income tax. Kansas spent 40% more per resident than the states without an income tax, and spending this year is $1.2 billion higher than in 2018.

The state Consensus Revenue Estimating group will release new revenue estimates later today, and we will update the budget models we recently published shortly thereafter.

Moody’s COVID scenarios

Moody’s estimates are based on two scenarios.

Baseline Scenario – Moderate Stress

— Deep recession in the first half of 2020 followed by a modest rebound. Travel and business restrictions in effect through late second quarter.

— Peak jobless rate of 13% in the second quarter of 2020, with peak-to-trough real GDP decline of 10%

S3 Scenario – Severe Stress

— Travel and business restrictions last into the third quarter, delaying recovery and causing more long-term disruptions.

— Peak jobless rate of 17%, and peak-to-trough real GDP decline of 14%.

COVID appears worse than the Great Recession

Moody’s says their COVID impact estimates are unique relative to other stress tests they’ve done because of the timing of the economic disruption.

“In most economic contractions, demand begins to fall off gradually as supply continues to expand. This fundamental mismatch in the economy results in supply being reduced, and jobs and incomes lost, almost as if the economy runs out of gas. This usually lasts for a period of up to five or six quarters, and in the case of the Great Recession, even longer.

“However, the current set of scenarios is more comparable to someone just pulling the plug on the economy. It is not that sufficient demand was not there, it is that many of the physical activities that drive economic growth became infeasible overnight or outright illegal. Because, by our preliminary estimates, up to a third of the economy was suddenly pulled off line through travel restrictions and business closures, the severe amount of economic stress being experienced is equally sudden and unprecedented.”

Conclusion

As if further proof was needed, Moody’s again confirms that the Kansas fiscal house has been in bad shape for a long-time. Before Sam Brownback, Kansas’ elected officials simply kicked the can down the road. Brownback, Democrats, and most Republicans refused to reduce wasteful spending. Now, following three consecutive years of income tax hikes, spending is even more out of control and, to quote Yogi Berra, it’s like deja vu all over again – the governor, Democrats, and many Republicans aren’t willing to eliminate wasteful spending.

Record-setting budgets have left Kansas uniquely ill-equipped to weather a crisis. Now, the crisis has come and we’ll be looking to our elected leaders to actually lead. And we’ll be there with them, with our 40-point COVID Economic Recovery Plan to show the way.