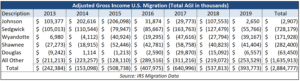

People are continually ‘voting with their feet’ as they leave high tax states like Kansas, and that has taken $2.9 billion of adjusted gross income out of the state over the last seven reported years. Indeed, the rate is increasing as IRS migration data for the years 2013-2019 shows the net loss (In-Migration minus Out-Migration) is widespread and much worse than earlier in the decade.

After net losses of $242 million and $153 million in 2013 and 2014, the loss jumped to $509 million in 2015 and averaged $495 million over the next four years. That’s an alarming trend and it is probably not a coincidence. It became apparent in 2015 that the Brownback income tax plan was in serious trouble when Republicans voted to raise the sales tax instead of reducing waste to balance the budget. Then Kansans were hit with the largest tax increase in state history in 2017, and taxes increased again in 2018 and 2019.

Each of the state’s five largest counties had net losses due to people ‘voting with their feet’ to move elsewhere in the United States, contradicting the notion that out-migration largely affects rural areas. Johnson County gained $306 million in 2013 and 2014 but has since lost $309 million. Three of the last five years show losses, and 2019 was barely positive.

Sedgwick County suffered serious losses every year since 2013, which total $728 million. Shawnee County lost $282 million and also lost AGI each year. Wyandotte County had a net loss of $172 million and Douglas County lost $63 million.

This out-migration of income is bad news for the jobs picture in Kansas. People leaving for better job opportunities or lower taxes makes it more difficult for employers to find skilled and professional labor, and too much of that prompts businesses to look for opportunities in other states.

More of the same is not the solution

Instead of bold action to stop the bleeding, state and local government officials mostly keep doing the same things that haven’t worked in the past. The state’s official economic growth plan – the Framework for Growth – is mostly more government spending and handouts to attract new business.

The Tax Foundation recently said Kansas has the worst effective tax rates in the nation on mature businesses, and subsidies going to new businesses are part of the reason. Academic studies on two subsidy programs – PEAK and STAR Bonds – showed both programs to be, at best, ineffective. But even if one of the handout programs showed a little benefit, it makes no sense to shower millions of dollars on a few businesses while families and businesses take billions out the back door to other states.

Taxes aren’t the only reason people are voting with their feet, but the relationship between taxes and economic growth is clear. States that spend less, tax less…and grow more. In 2019, the states with an income tax spent 56% more per resident providing the same basic services as the states without an income tax. And because they spent so much more, they charged 44% higher taxes per resident. The states that don’t tax income experienced 53% growth in private-sector jobs between 1998 and 2019, more than double the 26% growth in states that tax income. The states without an income tax also had superior growth in wages (162% vs. 118%) and GDP (173% vs. 131%).

Despite all this, Governor Kelly is setting Kansans up for another income tax hike if she gets a second term. She proposed a budget this year that spent about $166 million more than projected revenue, and her KPERS reamortization plan would cost taxpayers an extra $4.4 billion over time.

Less regulation, less spending, lower taxes prevent people voting with their feet

Excessive tax rates led to Kansas spending 42% more per resident in 2019. Kiplinger’s says Kansas is the fourth-worst state on taxes for retirees, and the Tax Foundation says Kansas has the eighth-highest state and local sales tax rate in the nation. Kansas also has some of the highest effective property tax rates in the nation, according to the Lincoln Institute of Land Policy.

Our 2021 Green Book shows that the states without an income tax collectively gained 6.2 million people from domestic migration between 2000 and 2019, and they came from states with an income tax. And don’t try to lay that off as a weather issue; South Dakota and New Hampshire have gained from domestic migration but Hawaii and California had significant losses.

Reducing taxes by eliminating waste and unnecessary spending at the state and local levels can make a big difference. Kansas has six times more cities, counties, and townships than the national average on a per-capita basis, and officials can save more money by consolidating services across boundaries.

Business leaders often say that state and local regulatory burdens are as big a problem as the tax burden, and those are easy fixes.

Doing more of what is causing significant out-migration will only make the problem worse. The good news is that proven solutions are readily available if state and local officials put taxpayers’ interests first.