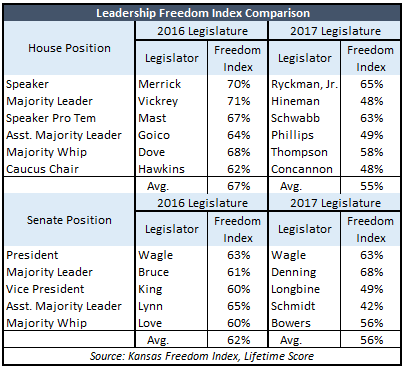

Legislative leadership teams will lean more to the Left in 2017, favoring higher taxes and less economic and personal freedom based on the Lifetime Kansas Freedom Index scores for the House and Senate. The 2016  House leadership team had a lifetime average score of 67 percent, with 50 percent being a ‘neutral’ score (voting equally for and against freedom issues). The average Lifetime Freedom Index of the 2017 leadership team is just 55 percent, with half of the members voting more often against freedom issues over their time in the Legislature.

House leadership team had a lifetime average score of 67 percent, with 50 percent being a ‘neutral’ score (voting equally for and against freedom issues). The average Lifetime Freedom Index of the 2017 leadership team is just 55 percent, with half of the members voting more often against freedom issues over their time in the Legislature.

The Senate leadership average drops from 62 percent to 56 percent but the shift may be more dramatic than their Lifetime Freedom Index suggests. Susan Wagle has reportedly made many promises to move the Senate decidedly Left in order to win re-election to Senate President, and is expected to name Carolyn McGinn chair of Ways & Means. Senator McGinn has the lowest Lifetime Freedom Index among Senate Republicans at 41 percent and would replace Senator Ty Masterson, whose Lifetime Freedom Index is 64 percent.

But those scores are history. All legislators, including those in leadership roles, have an opportunity to start fresh. The past may have been presented by members of both parties as a choice between higher taxes and less services but that was just politics. Kansans can have low taxes and good quality services if enough legislators have the political will to put citizens’ well being ahead of special interest groups that demand higher taxes.

A December 2015 market research study conducted by SurveyUSA on behalf of Kansas Policy Institute asked Kansans whether they believe state government “…operates pretty efficiently and makes effective use of my tax dollars;” only 25 percent agreed, with 69 percent disagreeing and 6 percent uncertain. Belief that state government operates inefficiently crossed all geographic boundaries and self-described political ideologies. And the data supports Kansans’ intuition; in 2015, Kansas budgeted to spend 34 percent more per-resident than states without an income tax. Every state provides education, highways, social services, etc., but those that do so at a better price can also have lower taxes.

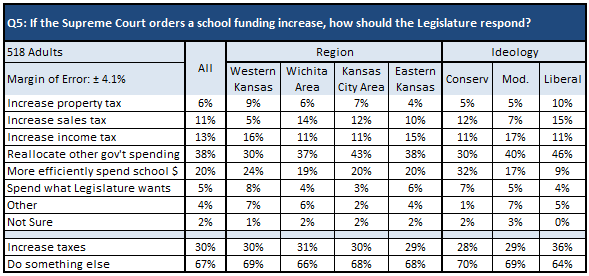

Even asked whether they supported tax increases to give more money to education, Kansans overwhelmingly said ‘no’ in a March 2016 survey. Only 30 percent favored some form of tax increase but 67 percent said to do something else, and that sentiment ran the full geographic and self-described ideological spectrum. If the real goal is to get more resources into Instruction and improve outcomes, that can be accomplished by requiring schools to make better use of existing resources.

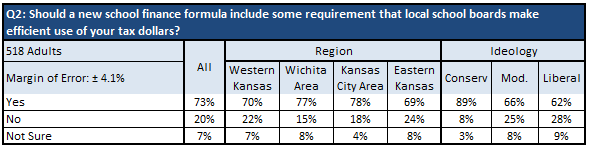

The 2017 Legislature must also develop a new school funding formula and that same survey showed a strong desire for requiring schools to operate efficiently, which will again force legislators to choose between citizens’ wishes and an education system that opposes efficiency measures.

Many of the faces in the Capitol will be different come January but the fundamental issue remains the same: whether the economic freedom interests of all Kansans prevail over the special interests that demand higher taxes. Kansans can have low taxes and efficiently-provided good quality services if enough legislators are willing to stand up up to the political pressure.

Many of the faces in the Capitol will be different come January but the fundamental issue remains the same: whether the economic freedom interests of all Kansans prevail over the special interests that demand higher taxes. Kansans can have low taxes and efficiently-provided good quality services if enough legislators are willing to stand up up to the political pressure.