Kansas Governor Laura Kelly’s Proposed Budgets for FY 2022 and FY 2023 plan to set new spending records. The Governor’s Budget Proposal released the day after her 2022 State of the State speech contains a proposal to increase All Fund Spending for FY 2022 to a total of just under $23 billion. This is $1.34 billion higher than the approved budget for the fiscal year ending in June. Kelly’s proposal is also $2 billion more than the Responsible Kansas Budget, which limits spending growth to inflation plus population.

In the General Fund, which is a subset of the All Funds budget, the proposed General Fund budget through FY 2022 is $9.33 billion, which is about $2 billion than was spent last year.

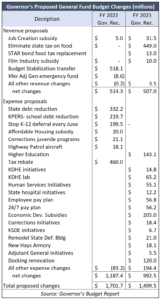

General Fund proposed revenue and expenditure changes

The state began the year with a $2 billion ending balance and revised revenue estimates have expected to boost it to $3 billion by the end of June. But Kelly’s proposed changes totaling about $2.3 billion would drop the balance to $671 million at the end of next year.

The two largest proposed changes to revenue deal with the sales tax on food and the budget stabilization fund. Eliminating the state sales tax on food (but keeping the local sales tax) would cost $462 million in the first year, including a $13 million subsidy to local governments for their STAR bond payments. (A quirk in the law allows cities and counties to keep some state sales tax revenue to pay off STAR bond debt.)

The two largest proposed changes to revenue deal with the sales tax on food and the budget stabilization fund. Eliminating the state sales tax on food (but keeping the local sales tax) would cost $462 million in the first year, including a $13 million subsidy to local governments for their STAR bond payments. (A quirk in the law allows cities and counties to keep some state sales tax revenue to pay off STAR bond debt.)

A one-time transfer of $518 million would be made to the budget stabilization fund for use in future emergencies.

Gov. Kelly would also spend over $260 million on economic development subsidy programs, which fail to bring about meaningful investment at the cost of taxpayer dollars. Some of these are revenue reductions and others are classified as expenditures.

A proposed $250 per person tax rebate, costing $460 million, also is listed as an expenditure. Rebates and sales tax cuts make for good election fodder but neither will make much of a dent in tax competitiveness. Kansans would be better off in the long run with reductions to income tax rates.

Some proposed spending changes, like debt reduction and one-time asset purchases (if truly needed) are good uses of budget surpluses. Others, like a $200 million gift to public schools and a long list of undefined “initiatives,” inevitably increase ongoing spending and further strain taxpayers.

A boost for higher education will cost taxpayers $1.43 billion over the next ten years. Governor Kelly hopes universities will use the money to freeze tuition next year, but taxpayers and students would be far better off following the lead of Purdue University. Under the leadership of president and former governor Mitch Daniels, Purdue has frozen tuition for the past nine years as a result of a cohesive effort to operate more efficiently – making it one of the most affordable schools in the Big 10 (and cheaper than attending the University of Kansas.)

There are myriad opportunities to reduce costs. As Daniels has said, “This place was not built to be efficient. [But] you’re not going to find many places where you just take a cleaver and hack off a big piece of fat. Just like a cow, it’s marbled through the whole enterprise.”

He was speaking of Purdue, but it universally applies to all forms of government.

With the state awash in cash, legislators should act carefully to avoid rapidly expanding spending faster than the state can support from a temporary surplus.