City and county officials in Johnson County recently told the Kansas City Star they are ‘puzzled’ by sluggish sales tax collections and consumer spending. They shouldn’t be. Local officials should realize the obvious. Kansans are dealing with their third consecutive year of state income tax hikes. Local officials also raised property taxes, and tax increases take a big bite out of Kansas shopping.

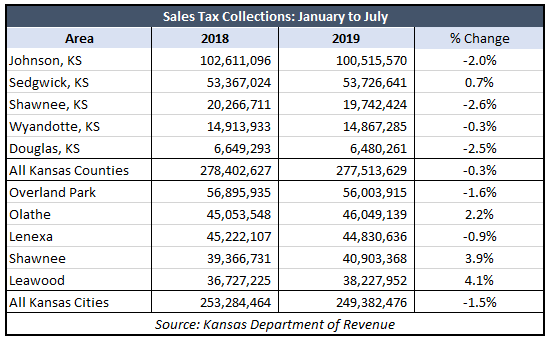

The table below breaks out the top five largest Kansas counties and five largest Johnson County cities in terms of sales tax for the first half of the year. Four out of the five largest counties in Kansas show consumer sales are shrinking. All Kansas counties and cities are in a similar boat. These percent changes include inflation (price growth) of 1.6%. So if you factor that out, the shopping situation in Kansas becomes even grimmer.

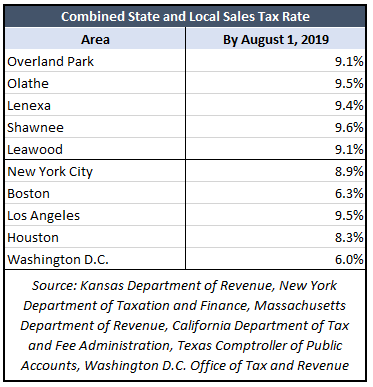

The direct cause of declining consumer spending is state and local tax policy. Without considering special taxing districts, the largest cities in Johnson County have tax rates higher than nine percent. Contrast those Kansas sales tax rates, with sales tax rates in the largest and most influential population centers of the country, and you will find that residents in Johnson County cities pay a higher tax on goods and services than those in New York City, Boston, the nation’s capital, and Houston. If we include Kansas’s special taxing districts the sales tax rate climbs into double digits. As an example, places like the Conference Center Hotel in Olathe has a combined sales tax rate of 11.475 percent. It makes no wonder why Kansas has the 8th highest combined state and local sales tax rate in the country.

The direct cause of declining consumer spending is state and local tax policy. Without considering special taxing districts, the largest cities in Johnson County have tax rates higher than nine percent. Contrast those Kansas sales tax rates, with sales tax rates in the largest and most influential population centers of the country, and you will find that residents in Johnson County cities pay a higher tax on goods and services than those in New York City, Boston, the nation’s capital, and Houston. If we include Kansas’s special taxing districts the sales tax rate climbs into double digits. As an example, places like the Conference Center Hotel in Olathe has a combined sales tax rate of 11.475 percent. It makes no wonder why Kansas has the 8th highest combined state and local sales tax rate in the country.

County government, collectively, has pushed property taxes to record levels, about 164% higher than in 1997. In 2017, the state government raised income taxes by more than $1 billion. Just last year Kansans paid 11% more in state income tax. With state spending outstripping revenues and hitting record levels, another billion-dollar tax increase could be on the way.

These higher taxes on wages and business income combined with the value of homes depress Kansans’ discretionary income. It means fewer purchased goods and services, which slows sales tax growth. Real-world problems are rarely the result of one issue. However, elected leaders must realize their decisions to raise taxes directly impacts consumer spending in Kansas.