In February 2022, the state of Kansas took in a total tax revenue of $502 million, which was 3.9% greater than the estimates for this month. This includes $255 million in sales taxes and $212 million in income taxes. The tax revenue collected for February of this year was 10.2% higher than what it was in February of last year.

In total, the tax revenues thus far in FY 2022 are just over $5.7 billion – roughly 4.0% greater than the estimates for the year. Similarly, this year’s cumulative revenue is 5.6% greater than the cumulative revenue projection of FY 2021 in January of last year.

Kansas’ increased revenue intake over the past year isn’t unique as almost every state across the country is seeing an influx of cash. Missouri currently holds more than $4 billion in unappropriated funds from the past year. Colorado alone has $3.3 billion it can spend – not to mention $2.6 billion in COVID-19 relief funds on their plate too.

States are faced with the decision of what to do with the surplus money – expand or limit the size of government. Kansas legislators should be careful with the state’s surplus: the government should avoid either a massive spending spree or massive tax cuts without a plan to offset those costs in the future – otherwise, taxpayers will foot a bigger bill in the future.

One place that’s enacted massive pro-growth tax reforms with their budget surplus is Iowa. The largest change is a five-year plan to reduce the state’s nine individual income tax brackets with a top marginal rate of 8.53% to one bracket of 3.9% for everyone. Because income taxes reduce people’s savings, an estimate by the Brookings Institution estimates that a flat tax would raise long-term savings by 10-20%. This is money that taxpayers could use to support businesses through their consumption or put in a bank where it is loaned for investments.

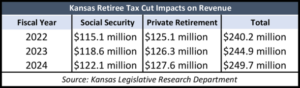

The other massive change is a complete repeal of Iowa’s retirement tax by FY 2023 which affects things like pensions, 401ks, and more. This change would be especially welcome in Kansas: in December of last year, Kansas was ranked as the fourth least tax-friendly state for retirees across the entire country by Kiplinger. Private retirement plans like IRAs, 401ks, certain Social Security benefits, and out-of-state public pensions are all fully taxed. Eliminating this tax when in-state public sector pensions are already not taxed would make the system more equitable and make it easier for retirees to stay in the state. The costs of such reforms can be seen in the below table.

The other massive change is a complete repeal of Iowa’s retirement tax by FY 2023 which affects things like pensions, 401ks, and more. This change would be especially welcome in Kansas: in December of last year, Kansas was ranked as the fourth least tax-friendly state for retirees across the entire country by Kiplinger. Private retirement plans like IRAs, 401ks, certain Social Security benefits, and out-of-state public pensions are all fully taxed. Eliminating this tax when in-state public sector pensions are already not taxed would make the system more equitable and make it easier for retirees to stay in the state. The costs of such reforms can be seen in the below table.

While instituting a flat tax or eliminating the retirement tax are likely to boost economic growth on their own, research shows that these changes can easily be undermined if not done as part of a larger reform program that considers reducing spending to account for lower tax revenues. This can be done though. Every state provides the same basket of services (education, transportation, social services, etc.), but some states do this more efficiently than others. For example, our 2021 Green Book research report shows that in 2019, the states that tax income spent 56% more per-resident than the states without an income tax. Kansas spent 42% more than the states without an income tax. Things like more oversight on discretionary spending and avoiding unneeded government expansion are two ways to do this.

Neighboring states that pursue pro-growth reforms like Iowa will pass Kansas in competitiveness as our state doles out billions in subsidies. Long-term relief such as rate reductions on taxes is possible with the ARPA and tax revenue cash pile, but only if done with responsible spending procedures to avoid a long-run deficit.