The Kansas tax proposal in House Bill 2023 would significantly raise taxes on many Kansas small businesses and would be retroactive to the beginning of this year. Legislators and others who support House Bill 2023 say the 2012 tax cut for partnerships, proprietorships, Sub-S corps, and LLC is a fairness issue and everyone should pay income tax. But while the pass-through exemption is a legitimate fairness issue, the proposed solution creates new fairness issues, would negatively impact job growth and effectively endorses cronyism and favoritism for government and government retirees.

A summary of Kansas Policy Institute’s rationale for testifying in opposition to HB 2023 follows and our full testimony can be found here.

Cronyism, Favoritism and Preferential Treatment for Government Employees

These issues have been brought to legislators’ attention many times in the past but their continued failure to address them effectively endorses the notion that government and its retirees deserve preferential treatment:

- Retirees of state universities and the Board of Regents participating in their 403(b) plan are exempt from state income tax on withdrawals. Private sector citizens are fully taxed on their pension and 401(k) withdrawals.

- Retirees of other state agencies, school districts and local government participate in the Kansas Public Employees Retirement System (KPERS). They are taxed on their personal contributions to the pension program but are never taxed on the majority of their withdrawals which come from employer contributions and earnings on all contributions.

- Legislators get an even better deal. In addition to preferential tax treatment, their pensions are based on having worked a full year and earned about $85,000 instead of what they are actually paid – less than $10,000 per year.

- The Legislature allows local government to exempt chosen businesses from state and local sales tax with the use of STAR bonds and Industrial Revenue Bonds, which makes less money available for schools and other services.

- The Legislature provides sales tax exemptions to a wide array business activities, services, retail purchases and many non-profit organizations (for the record, KPI pays sales tax) totaling more than $5 billion dollars annually. Some of the exempt entities even came to the Legislature one at a time asking for special treatment.

- The State of Kansas’ HPIP program exempts businesses selected by government from sales tax and provides income tax credits. The PEAK program allows businesses chosen by government to keep 95 percent of their eligible employees’ state income tax withholding for up to 10 years.

At the hearing on this Kansas tax proposal, some legislators acknowledged that there are many other unfair treatments in the tax code but showed no interest in dealing with them now.

Other Fairness Issues

Unfairness is even baked into the State Constitution; owners of commercial and industrial real estate are charged 2.2 times the effective tax rate of residential real estate because their property is taxed at 25 percent of appraised value while homeowners are taxed at 11.5 percent of appraised value.

State government continues to operate very inefficiently, having spent 27% more per-resident in 2015 than states without an income tax. If fairness is the issue, the revenue from reversing the pass-through exemption would be used to reduce other taxes.

And how exactly is it fair to retroactively tax people who have already made plans and investments in their businesses based on existing tax law?

Economic Impact

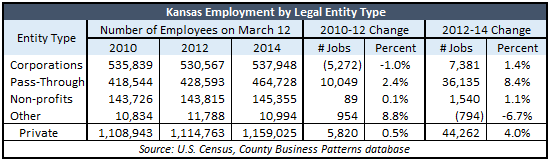

Pass-through entities (businesses not organized as C-corporations) added 36,135 jobs and grew by 8.4 percent compared to C-corporation growth of just 1.4 percent and 7,381 jobs, so putting a new tax on the businesses that are driving job growth will have a negative economic impact.

How is that fair to the people who will likely lose their job or have fewer employment opportunities as a result of this Kansas tax proposal?

Conclusion

Conclusion

This Kansas tax proposal to put a big tax hike on small business in the name of fairness, consciously ignores all other fairness issues and would unnecessarily extract over $200 million from the economy – so that government can continue to operate inefficiently and legislators can continue to hand out favors to preferred employers, government retirees and themselves.