Last September I made a very safe prediction for the 2017 session of the Kansas Legislature – “Regardless of who is elected to the 2017 Legislature, January will bring turmoil and major disappointment for many Kansans.” Like I said, a pretty safe bet…but the rationale ruffled a few feathers. “Many candidates and special interests say Kansas needs to spend a lot more money (the time-honored way to get elected) and many of them at least imply that taxing small business will unlock the spending spree. But the math doesn’t work, so those promising big spending increases either don’t know the math doesn’t work and won’t be able to deliver on their spending promises or they aren’t saying that they also plan to stick you with a very large tax increase.”

Many of those vote-for-me specific and implied promises were broken. The reasons varied and in some cases, the broken promises were not entirely within the control of an individual legislator. Regardless, those who voted for the budget and tax plan must own the responsibility.

The $900 million plucked-from-sky funding increase called for by the State Board of Education was fortunately whittled down to $284 million (and even that was inflated by legislative math errors) but the legislature failed to truly hold schools accountable for improving outcomes. Very few people promised to raise income taxes on low income Kansans or the middle class, but that didn’t stop a veto override that imposed double-digit tax hikes on every Kansan and even put some low-income citizens back on the tax rolls. The total increase is $3 billion over five years.

And they can’t claim that that’s what voters wanted. Market research studies conducted by Fort Hays State University, the Kansas Chamber and Kansas Policy Institute each showed voters wanted spending reductions to be the primary method of balancing the budget and that they overwhelmingly opposed tax increases on low and middle income families.

And they can’t claim that that’s what voters wanted. Market research studies conducted by Fort Hays State University, the Kansas Chamber and Kansas Policy Institute each showed voters wanted spending reductions to be the primary method of balancing the budget and that they overwhelmingly opposed tax increases on low and middle income families.

The Kansas Truth Caucus and KPI offered multiple scenarios to balance the budget without a tax increase, including the securitization of future tobacco settlement payments, a one-time / $196 million use of excess school carryover cash reserves, efficiency savings and other spending restraints. Most in the Kansas Legislature, however, had little interest in making better use of existing resources to avoid a tax increase.

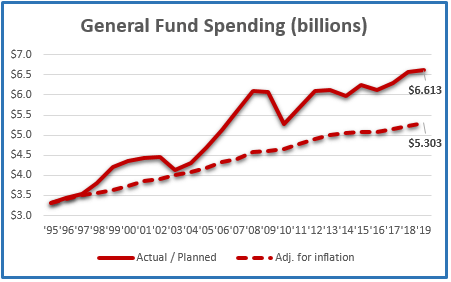

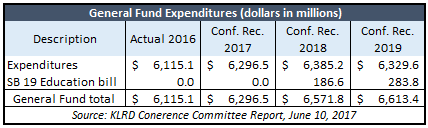

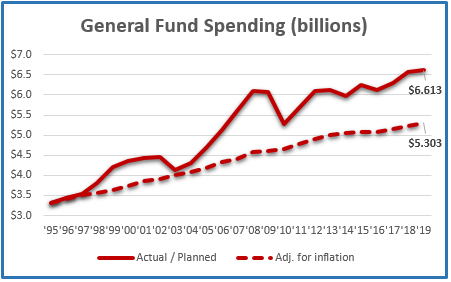

Those favoring Medicaid expansion gave it a good run but it failed. There was little effort put into reducing the sales tax rate, the highway transfers remain and KPERS pension funding is still being deferred. Remember all the campaign talk about structural budget reform? The budget and  tax plans that so many voted for don’t even come close and in fact, the 2020 budget is already out of balance. Oh, they raised taxes a lot but a chunk of that went to create even more spending records. The adjacent summary from the June 10 budget conference committee report shows almost a half billion dollar increase was approved over three years.

tax plans that so many voted for don’t even come close and in fact, the 2020 budget is already out of balance. Oh, they raised taxes a lot but a chunk of that went to create even more spending records. The adjacent summary from the June 10 budget conference committee report shows almost a half billion dollar increase was approved over three years.

Spending is expected to jump $181 million this year, another $275 next year and $42 million more in FY 2019; real spending is even higher because of deferred KPERS pension payments. If inflation holds steady at 1.4 percent the next two year, the budget of $6.6 billion for FY 2019 will be $1.3 billion above long term inflation. And even adjusting for population growth, per-capita spending would be $625 million lower in FY 2019 if just increased for long term inflation.

Fair warning – the same Kansas Legislature will be back next year and the forecast calls for more stormy weather.

Fair warning – the same Kansas Legislature will be back next year and the forecast calls for more stormy weather.