COVID-19 and government orders continue to wreak havoc on Kansans’ livelihood and finances. Under an economic recession, the state government should feel the pain as well. However, with a looming $1.5 billion state budget shortfall, Gov. Kelly refuses to balance the budget. Instead, her latest plan intends to skip debt payments, push spending into the next fiscal year, and leave state agencies virtually untouched.

On Thursday, June 25th, members of the State Finance Council met to discuss the state’s budget health. In the aftermath of COVID-19 and government-induced lockdown measures, the state could lose $543 million compared to the 2019 fiscal year.

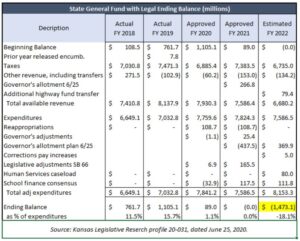

According to the Kansas Legislative Research Department in the adjacent table, the government would see a $1.5 billion budget hole by 2022. As my colleagues at The Sentinel pointed out, the table above only gets Kansas to a zero balance. To maintain a legally-balanced budget would require“$499 million in additional changes this year, $70 million next year, and $1.5 billion would still be required in FY 2022 to finish each year with 7.5% in reserve.” It also potentially underestimates the economic impact of COVID-19 and government lockdown measures.

According to the Kansas Legislative Research Department in the adjacent table, the government would see a $1.5 billion budget hole by 2022. As my colleagues at The Sentinel pointed out, the table above only gets Kansas to a zero balance. To maintain a legally-balanced budget would require“$499 million in additional changes this year, $70 million next year, and $1.5 billion would still be required in FY 2022 to finish each year with 7.5% in reserve.” It also potentially underestimates the economic impact of COVID-19 and government lockdown measures.

With the state budget already passed in March at a record of $8 billion, Gov. Kelly can make allotments, including budget cuts, to maintain the state’s yearly balanced budget requirements. However, the lion share of Gov. Kelly’s budget fix is not a budget reduction. Out of her $683 million two-year plan,

$264 million (39%) is delaying planned loan repayments

$147 million (21%) in welfare savings tied to a full economic recovery from COVID-19

$77 million (11%) in education savings by pushing expenditures into July 2020 (fiscal year ends June 30th)

“There’s no general operating reductions to state agencies in this plan.” – State Budget Director Larry Campbell

So far, over 100,000 Kansans lost their jobs and income. However, the state government remains untouched. Compared to February (Pre-COVID impact), the private sector economy sent 107,000 Kansans home, and state government jobs fell by just 200. With significant economic sectors shuttered, many state agencies and jobs likely have less work to do. Yet, Governor Kelly still allowed state executive branch employees to receive salary and benefits despite not working.

According to Homebase Inc., a national scheduling tracking tool, the Kansas economic recovery has stalled and turned downward. Despite the lockdown ending in May, small business activity is 20% lower than in January 2020. The public health crisis understandably changed the way we conduct business. Small businesses understand there’s no guarantee they can keep operating. Businesses continuously look in the mirror and work out if they can adapt and reopen or shut down permanently. Yet the Governor’s budget reflection puts no such responsibility on its various agencies and departments.

When families and businesses cut back due to COVID-19 and government lockdowns, it is truly unfair that the Kansas government has no intention of sharing in the pain. We must never forget, the government only exists with taxes, and those taxes only come from those who produce; the private sector. Gov. Kelly’s budget adjustment puts short-term spending ahead of the long-term fiscal solvency; there is a place to start half of the state budget in K-12 education. As Kansans restructure their livelihoods amid COVID-19 and government policy, it’s only fair that the government should restructure themselves as well.