As a “thank you” to Governor Kelly’s property tax reform veto, many Kansas county and city governments announced plans to raise taxes, making it harder for Kansans to earn a living and survive the impact of COVID-19. At a time of an economic depression, one would think tax hikes on family homes and businesses as the worst thing to spark a recovery. However Kansas counties and cities have different priorities. Kansas local governments are not interested in placing economic recovery above their spending plans.

At the end of the 2020 Kansas legislative session, Governor Kelly took another step in denying Kansans tax relief. After raising income taxes, monkeying with sales taxes, and raising income taxes again, the Governor vetoed property tax reform late this spring. If passed instead of vetoed, the reform would have required Kansas county and city commissions to have public hearings on tax increases. Additionally, they would have to take a specific vote if they planned to increase property tax revenues. This package was overwhelmingly popular across party lines – passing both chambers with veto-proof majorities – and garnered the support of over 75% of Kansas voters. The Governor said the following to justify her veto,

I have long supported responsible property tax relief, but the provisions of HB 2702 cause more problems than they solve. Now is not the time to create more problems and burdens for local governments.

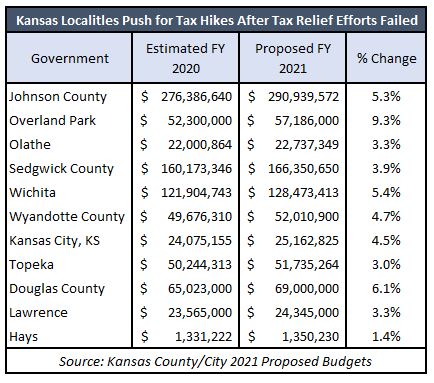

Note, the Governor’s concern wasn’t about the fact she exacerbated problems for Kansans, or that she wished to relieve the burden on Kansas families amidst the COVID-19 pandemic. Her interest was to spare local governments from cost-cutting decisions that currently plagues nearly every Kansas family and business today. Thomas Sowell once said, “You cannot subsidize irresponsibility, and expect people to become more responsible.” It seems this quote also applies to Kansas local governments. Almost all local governments of major population centers plan to tighten the tax vice on Kansans’ wallets. Here’s a table of the tax impact for selected county and city governments.

At this time, not all Kansas counties and cities have announced their 2021 budgets, but some have. With the 2020 year not over yet, we compared the proposed 2021 budget to localities estimates for 2020. Kansas localities are either raising your mill rate or reaping the benefits of the increased value of your home without your permission. If the appraisal on your home rises, it doesn’t mean your taxes should go up automatically. The reason it does is that local leaders aren’t honest. Without property tax reform holding them accountable, Johnson County government will raise property taxes by 5.3%. If you live in Overland Park, the city government will also increase your taxes, on average, by 9.3%. In Sedgwick County, your bill will jump an extra 3.9%, and if you live in Wichita, another 5.4%.

At this time, not all Kansas counties and cities have announced their 2021 budgets, but some have. With the 2020 year not over yet, we compared the proposed 2021 budget to localities estimates for 2020. Kansas localities are either raising your mill rate or reaping the benefits of the increased value of your home without your permission. If the appraisal on your home rises, it doesn’t mean your taxes should go up automatically. The reason it does is that local leaders aren’t honest. Without property tax reform holding them accountable, Johnson County government will raise property taxes by 5.3%. If you live in Overland Park, the city government will also increase your taxes, on average, by 9.3%. In Sedgwick County, your bill will jump an extra 3.9%, and if you live in Wichita, another 5.4%.

You can read your community’s historical property tax hikes at BeeHonestKansas.org. If such tax hikes occur in bad times, it only makes sense they will occur in the good times and the foreseeable future.

It’s a shame that when times are tough, Kansas governments refuse to provide the relief the people need. Or, at the very least, tighten their belts along with Kansas families. With the U.S. Census data in our 2020 Green Book, there are more local governments for every Kansas man, woman, and child than 48 other states in the country. Additionally, Kansas has the 2nd worst state for local government employees per capita. All these extra government employees and agencies “require” a lot of government spending. Moreover, more government spending means more tax dollars out of your. Kansas has too much government and many cities and counties are doubling down on that when Kansans are least-able to afford it. If “Truth in Taxation” was important before it will only be more important in the future.