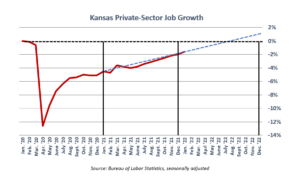

The January Labor Report from the Kansas Department of Labor shows Kansas gained 5,100 private-sector jobs. This represents a monthly job growth rate of 0.4%, which is the fastest since July 2021. At the same rate of growth that Kansas has experienced since the start of 2021, the state will fully recover to its pre-pandemic level of jobs by late June or early July of this year. Kansas is still 18,400 jobs below its January 2020 levels.

The job growth this month was fueled by 1,500 Professional and Business Service positions, 1,200 new Construction jobs, and 800 Manufacturing jobs. Trade, Transportation and Utilities, Financial Activities, and Education all saw modest growth at or below 500 jobs each. Leisure and Hospitality lost 400 jobs while Mining and Logging industries stayed roughly the same as last month. At the same time, 3,400 new Government jobs were created in Kansas.

The job growth this month was fueled by 1,500 Professional and Business Service positions, 1,200 new Construction jobs, and 800 Manufacturing jobs. Trade, Transportation and Utilities, Financial Activities, and Education all saw modest growth at or below 500 jobs each. Leisure and Hospitality lost 400 jobs while Mining and Logging industries stayed roughly the same as last month. At the same time, 3,400 new Government jobs were created in Kansas.

The unemployment rate in Kansas declined from 2.8% last month to 2.6% this month. At the time of this post, the exact labor force participation rate has not been released, but from the raw data, Kansas’ civilian labor force grew by 410 people with 2,269 unemployed people finding work. This is good news considering Kansas’ labor force participation rate was declining last month, meaning more people were leaving the labor market as a whole than finding or searching for work. A potential explanation for this change could be the end of the omicron surge of COVID-19 in Kansas. For example, the number of new daily new cases dropped from 11,377 on January 10th to just 64 two months later on March 10th.

By June of this year, the Kansas state budget will have roughly a $3 billion surplus accumulated from months of high tax collections. The legislature needs to quickly determine how to manage this surplus and responsibly balance future tax and spending policy. However, this goal has already been muddled. SB 347 which provides for billions of dollars in government subsidies to a mystery company is expected to create a budget deficit by FY 2026. This deficit is looming over other tax proposals like the $462 million elimination of the food sales tax, a $460 million tax rebate, and millions of dollars worth of other proposals.

While these policies vary from good with proper spending control (food sales tax) to a complete waste of taxpayer cash for no growth (the megasubsidy), the state should consider better long-term tax reform opportunities, such as lowering personal income tax rates. A one percent drop in a state’s personal income taxes corresponds to a .78 percent increase to a state’s GDP. This comes from the fact that the 256,950 small businesses in Kansas pay more in personal income taxes than in corporate income taxes due to their tax status. A tax on personal income is discouragement from work and also creates a barrier for owners to expand their businesses, thus harming GDP growth.

In any case, legislators need to think responsibly about how taxpayer dollars are spent – now and in the future.