The Kansas Senate recently passed a Kansas RELIEF Act which returns roughly $450 to $470 million to Kansans. Under a Balanced Budget Plan, the RELIEF Act can spur a statewide economic recovery from the COVID pandemic.

The Kansas “Rebuilding Employers and Livelihoods: Investing in Everyone’s Future” or RELIEF Act has many provisions that focus on helping Kansans keep more of what they earn.

- Ensures unemployed Kansans do not pay state income taxes on fraudulent claims.

- Increases the standard deduction (income you do not pay state income taxes on) by 20% next April 2022, and an additional 12.5% by April 2023.

- Allows Kansans to itemize on their Kansas return regardless of the deduction/itemization on their federal return.

- Exempts all retirement income from state taxation.

- Exempts international income held overseas from state taxation.

- Exempts CARES loans and expenses made with CARES loans from state taxation.

Repeated, recent tax hikes and relatively high rates means that Kansans are driven to leave the state to find opportunities elsewhere. This is also evident as Kansas has fallen further behind the nation in job and economic growth. Before COVID, Kansas was listed as the 10th least tax-friendly state in the nation, the 3rd least tax-friendly state for retirees, and only gained 6,000 private jobs over the year, the third slowest annual job growth in almost a decade. Since COVID, 29% of Kansas small businesses are closed, consumer spending fell 5 points compared to January 2020, and tens of thousands of Kansans have quit job hunting.

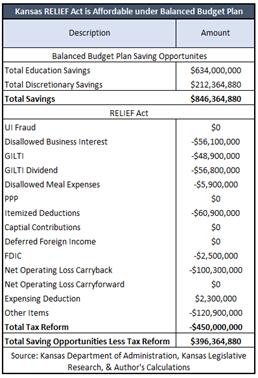

In the adjacent table, we compared the Kansas RELIEF Act and the taxpayer savings from the Balanced Budget Plan. The Kansas legislature can engage in the recommendations of the Balanced Budget Plan and reduce waste up to $850 million. Using the framework of the Balanced Budget Plan while passing the RELIEF Act still leaves the state with up to an extra $400 million in the fiscal year 2022 ending balance. Those additional savings, if realized, could finance more tax relief, or cushion the budget from the next emergency. Tax reform is feasible if made deficit-neutral, financed by removing government waste.

In the adjacent table, we compared the Kansas RELIEF Act and the taxpayer savings from the Balanced Budget Plan. The Kansas legislature can engage in the recommendations of the Balanced Budget Plan and reduce waste up to $850 million. Using the framework of the Balanced Budget Plan while passing the RELIEF Act still leaves the state with up to an extra $400 million in the fiscal year 2022 ending balance. Those additional savings, if realized, could finance more tax relief, or cushion the budget from the next emergency. Tax reform is feasible if made deficit-neutral, financed by removing government waste.

Ultimately, what is most important here is that the Kansas RELIEF act must have a structural, or permanent, pay-for. Additionally, that pay-for should not be a tax increase. To Gov. Kelly’s credit, she proposed lowering taxes in some form as well but plan to finance it with tax increases elsewhere. This weakens the Governor’s intention to help Kansans recover. Moreover, it ultimately raises costs on the same Kansans she may profess to help.

There is only one option that maximizes benefits for Kansans over the long-term and keeps the state budget above water. The Kansas RELIEF Act must be deficit-neutral. It is not going to be easy. However, it’s time for Kansas policymakers to act on their stated goal of “fiscally responsibility”. If they succeed, Kansans will be better off for it.