Everyone from elected officials, government unions, and the Brookings Institute is calling for hundreds of billions more in federal bailouts for states and local governments. There’s no question that government-ordered shutdowns will cause tax revenue to plummet, but bailouts will only make matters worse for employers and individual taxpayers.

The longer that states impose shutdowns, the worse the economic impact becomes, and covering government revenue losses with federal bailouts just encourages them to keep the economy shuttered. People and employers in the private sector are scrambling to keep their heads above water, and while some are getting a portion of their government-imposed losses offset by the feds, that won’t begin to end the suffering.

It’s time to pay property taxes now, and people are wondering where they’ll find the cash. But states and local governments collectively have plenty of cash. The most recent U.S. Census Annual Survey of State and Local Government Finances shows they had $1.66 trillion in cash and securities in 2017; that was $572 billion more than they had in 2007, before the start of the Great Recession. (That’s just what Census classifies as ‘other’ and excludes cash in insurance trust funds, bond funds, and cash held to offset debt.)

The State of Kansas began this fiscal year with $4.7 billion on hand. A good portion of that is restricted, but to the extent possible, legislators should remove restrictions and reduce agency budgets by the amounts they free up. According to the U.S Census report, local governments in Kansas had $6.9 billion in ‘other’ cash reserves in 2017; that’s $2.8 billion more than they held ten years prior, reinforcing their ability to cut spending and provide some immediate property tax relief.

Local government entities (cities, counties, townships, fire districts, etc.) increased property taxes by 180% over the last 22 years, while inflation increased 52% and the population grew by just 11%. That’s about three times the increase needed to keep up with inflation and population. Property taxes for education, including K-12 and community colleges, increased by 142%.

Drawing down cash reserves buys time to do the hard work of cutting wasteful spending, and there are lots of opportunities to make significant reductions. Former Indiana Governor Mitch Daniels explains how to go about it.

Drawing down cash reserves buys time to do the hard work of cutting wasteful spending, and there are lots of opportunities to make significant reductions. Former Indiana Governor Mitch Daniels explains how to go about it.

“This place was not built to be efficient. [But] you’re not going to find many places where you just take a cleaver and hack off a big piece of fat. Just like a cow, it’s marbled through the whole enterprise.”

Daniels made this statement about Purdue University, where he’s now president. And he practices what he preaches. In February, Purdue announced it was freezing tuition for the ninth consecutive year.

Every state provides the same basic basket of services, but some of them do so much more efficiently than others. The states that spend less are thereby able to tax less.

Data from the National Association of State Budget Officers show that the states with an income tax spent a whopping 55% more per resident in 2018 than the states without an income tax. That excludes spending of federal money and debt-related spending. It’s not access to oil or other revenue sources that make the difference; it’s the spending control. New Hampshire and Texas spent less than $2,800 per resident, while California spent over $4,400.

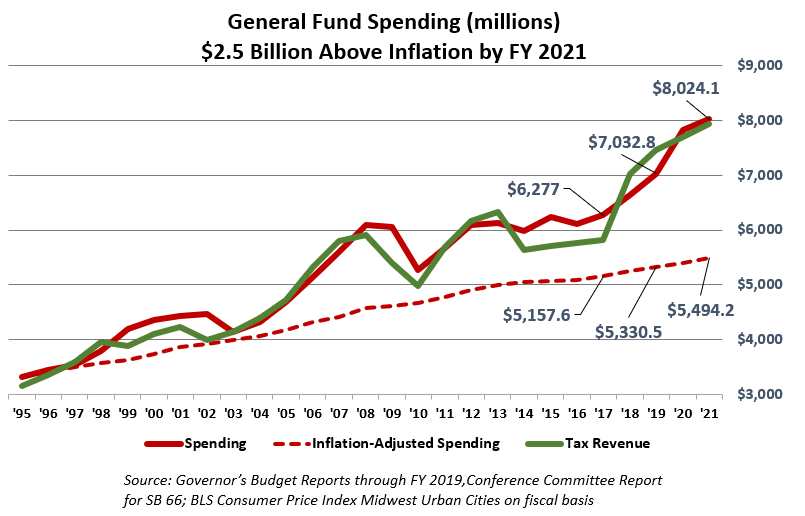

Kansas spent $4,040 per resident in 2018 – 40% more than the states without an income tax – and spending has increased by $1.2 billion since then.

Staffing accounts for a significant portion of government spending, and we’re massively over-governed here in Kansas. The U.S. Census Survey of Public Employment shows Kansas had 36% more government employees per capita than the national average, and they are mostly being held harmless from COVID-related layoffs.

Staffing accounts for a significant portion of government spending, and we’re massively over-governed here in Kansas. The U.S. Census Survey of Public Employment shows Kansas had 36% more government employees per capita than the national average, and they are mostly being held harmless from COVID-related layoffs.

Some cities and counties in Kansas confirm that no one has been laid off so far, while others have a few part-time employees on furlough. The Bureau of Labor Statistics reports a loss of 6,000 private-sector jobs for Kansas in March, while state and local government employment held steady. Kansas Governor Laura Kelly sent most state workers home with full pay, even if they can’t work from home or their roles are not necessary during the COVID situation.

No one wants to see anyone lose their job or have necessary government functions eliminated. But it makes no sense to give federal bailouts to states and local government so they can continue to over-spend and over-tax.

State and local governments ordered the economic shutdown, so let them do like the rest of us and learn to live on what they collect.