Lots of declarations are made on the campaign trail and town hall meetings, but when asked to declare their principles on key state budget and education issues, most Kansas legislators wouldn’t respond.

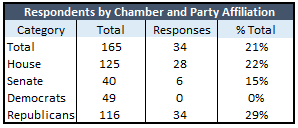

Kansas Policy Institute asked all 165 Kansas  legislators to respond to a 6-question multiple choice online survey between January 13 and January 30 but only 34 responded; some respondents didn’t complete the entire survey. It was made clear that all responses would be published with their names attached so citizens would have a better understanding of the principles their elected officials would uphold in the legislative session.

legislators to respond to a 6-question multiple choice online survey between January 13 and January 30 but only 34 responded; some respondents didn’t complete the entire survey. It was made clear that all responses would be published with their names attached so citizens would have a better understanding of the principles their elected officials would uphold in the legislative session.

Just 28 of the 125 House members replied and only 6 of 40 Senators. No Democrats and only 29 percent of Republicans would declare their principles. Two senators said they wouldn’t complete a survey but would be willing to discuss the matters, but in fairness to those who completed the survey we didn’t meet with them separately.

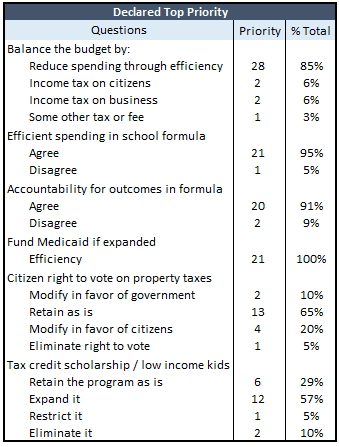

Asked their top priority for balancing the budget, 85 percent said they would reduce spending by being more efficient. One legislator opted for sales tax increases but 12 percent would raise income taxes and 3 percent would raise or implement some other tax or fee.

Asked their top priority for balancing the budget, 85 percent said they would reduce spending by being more efficient. One legislator opted for sales tax increases but 12 percent would raise income taxes and 3 percent would raise or implement some other tax or fee.

There was near unanimity on having the new school funding formula require some measure of efficiency and holding districts accountable for improved outcomes. Asked how they would fund Medicaid if expanded under Obamacare, every respondent said they would reduce spending by being more efficient.

If legislation is introduced to eliminate citizens’ right to vote (which has now been introduced), 85 percent prefer to either retain the right to vote or modify the terms in favor of citizens.

Finally, 86 percent said they want to preserve or expand the tax credit scholarship program that allows low income students to leave the worst performing schools in Kansas and go to a private school; 5 percent prefer to restrict and 10 percent want to eliminate the program; that legislation is being drafted.

Readers can speculate why so many Kansas legislators wouldn’t go on record with their principles, but it’s quite noteworthy that those who did respond overwhelmingly came down on the side of citizens and students. For the convenience of those who might want to contact their elected officials about this survey, the State provides contact information for all House and Senate members.

Here is the full survey document, followed by a downloadable list of individual responses.

- My #1 priority in balancing the state budget is:

- Increasing income tax on citizens

- Increasing income tax on business

- Increasing sales tax

- Increasing property tax

- Increasing or implementing some other tax or fee

- Reducing spending by eliminating inefficiency

- Sale of assets, transfers from other funds or other one-time solutions.

- A new school funding formula should include some requirement for spending money efficiently, with efficient defined as getting the same or better quality service or product at the best possible price.

- I agree

- I disagree

- A new school funding formula should hold school districts accountable for improving outcomes, with accountability meaning that there is a consequence for not improving outcomes and with improvement measured at the building level (improving over some period of time but not getting every building to the same level.)

- I agree

- I disagree

- If Medicaid is expanded as part of the Affordable Care Act, aka Obamacare, the incremental cost to the State of Kansas, including any future reduction in the federal matching rate, should be funded by:

- Increasing income tax on citizens

- Increasing income tax on business

- Increasing sales tax

- Increasing property tax

- Increasing or implementing some other tax or fee

- Reducing spending by eliminating inefficiency

- If legislation is introduced to eliminate citizens’ right to vote on whether property taxes should increase beyond inflation (the so-called property tax lid), which best describes your current position on the issue:

- Support citizens’ right to vote as currently in statute

- Modify the law to allow government more latitude to increase taxes without a public vote

- Modify the law to remove exceptions to the public vote requirement so that citizens have more control

- Eliminate citizens’ right to vote

- If legislation is introduced to terminate the tax credit scholarship program that allows low-income students in the state’s worst-performing schools to attend a school of their choice, which best describes your current position on the issue?

- Retain the tax credit scholarship program as currently in statute

- Expand the program

- Restrict the program

- Eliminate the program