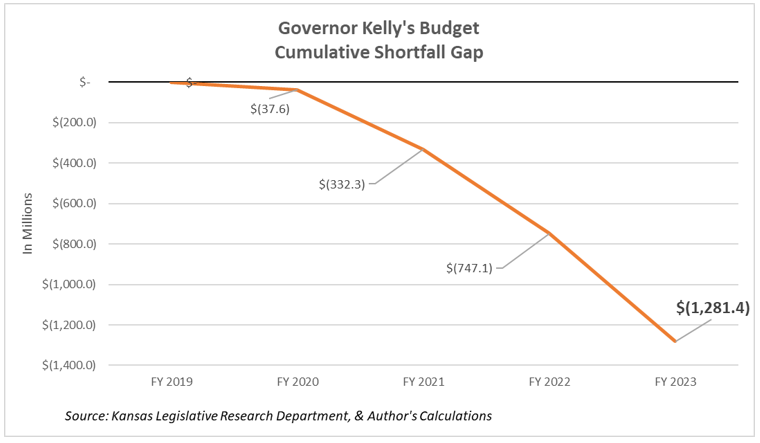

Governor Kelly’s claim to balance the budget without raising taxes certainly sounds appealing and has been met with lots of media coverage. However, the latest from state researchers shows little stops a $1.3 billion tax hike from hitting Kansans in four years.

In November, we reported figures from the Kansas Legislative Research Department (KLRD) showing Kansans on the hook for a billion dollar tax hike. Now we have specifics on Governor Kelly’s tax and spending goals. These estimates worsen the state’s checkbook to show a $1.3 billion tax increase . Record spending means higher taxes are needed to maintain the statutorily required 7.5% ending balance.

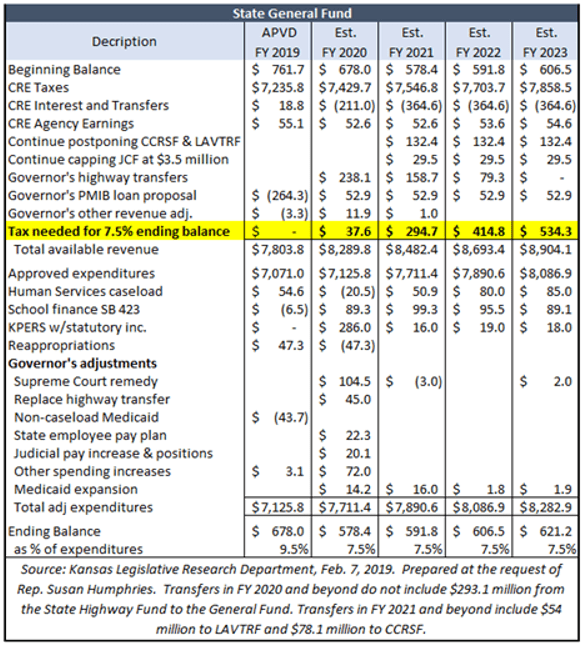

In the table above, the potential $1.3 billion tax increase allows the Governor’s transfers like highway fund sweeps. It also highlights the Governor’s proposed spending increases to Medicaid, and school funding to name a few. However, it also takes into effect the House’s recent action to not allow the re-amortization of KPERS payments. This tax increase also assumes Kansas taxpayers don’t receive the full benefit of federal tax reform. Not passing SB 22 means the state keeps all of the taxpayer proceeds.

Seen in the chart above, the Governor’s budget proposed record state spending instead of pulling back and being efficient. This means the only way to avoid incoming tax increases, is to break the vow to stop raiding the highway fund or to further delay KPERS payments. In all fairness, the use of budget gimmicks to avoid fixing structural fiscal problems have been used for decades. Kicking the fiscal can down the road was wrong when Governor Sebelius did it, wrong when Governor Brownback did it and is wrong today.

Kansas has had a structurally unsustainable budget for years, starting well before Governor Brownback. Yet, the current budget framework thinks it can avoid the reckoning.

Unless something changes in short order, Kansans could potentially see their 6th tax increase since 2015. Kansas voters state-wide have expressed a strong desire to pursue options that eliminate wasteful spending instead of hiking taxes. Kansans are in need of honest policy discussions with realistic solutions. Otherwise, the government’s fiscal picture will likely get worse.