Trillions in government spending and a supply chain crisis stemming from factors like energy production restrictions and businesses closed during COVID-19 lockdowns are costing Kansas families $8,700 annually in higher costs for food, energy, transportation, and housing due to inflation.

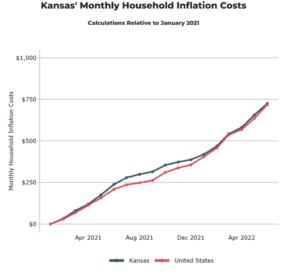

The estimated annual cost comes from the Congressional Joint Economic Committee and estimates inflation rates for each state since January 2021. The additional monthly cost of $725 in Kansas is slightly higher than the national average of $716.

And even if you get a cost-of-living pay increase, the government is first in line to get its share.

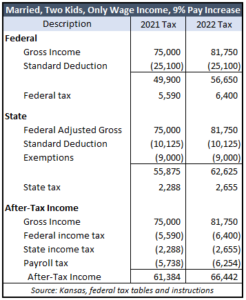

Here’s an example for a married couple with two kids: their wage income in 2021 was $75,000, they take the standard deduction, and they don’t have any tax credits.

A pay increase to offset 9% annualized inflation would boost gross pay by $6,750, but the net after income and payroll tax only goes up $5,058. Federal income tax is $810 higher, state income tax goes up $367, and Social Security and Medicare taxes take a $516 bite out of the pay increase.

And that’s just what comes out of your paycheck. School districts, cities, and counties are next in line with property tax increases. All the while, sales taxes are ticking up too with higher prices.

And that’s just what comes out of your paycheck. School districts, cities, and counties are next in line with property tax increases. All the while, sales taxes are ticking up too with higher prices.

Federal tax tables are indexed to avoid taxes on inflation-driven wage increases, but Kansas doesn’t do this. A straightforward reform would be to bring Kansas more in line with the national standard.

If state and federal government officials really want to help, they could cut spending and reduce taxes.

For starters, don’t give out billions in taxpayer money to subsidize a few favored businesses in the name of economic development. The research shows subsidies are ineffective and Kansas families need a lot more money. Emulate former Indiana Governor Mitch Daniels to cut wasteful spending. Daniels said, “This place was not built to be efficient. [But] you’re not going to find many places where you just take a cleaver and hack off a big piece of fat. Just like a cow, it’s marbled through the whole enterprise.”

Use the savings to cut marginal income tax rates for everyone, including businesses. Eliminating the state income tax on social security and private retirement income would also have a big impact. (State and local government pensions are already exempt from state income tax.) This year, Mississippi, Iowa, and Indiana all passed ambitious plans to reduce their individual income taxes in the long run and make their business climates more competitive.

Stimulating business and job growth by addressing regulation, housing, and rural broadband issues are also areas where the government can reduce costs and stimulate business through high inflation.

Kansas families are hurting, and government officials can help by efficiently using taxpayer money.