A new report shows Kansas is ranked 25th in the overall economic outlook, but economic performance falls to 41st fastest as tax increases take larger bites out of paychecks. These numbers are from the 13th edition of the American Legislative Exchange Council’s Rich States Poor States and show the harm of repeated tax hikes.

The Rich States, Poor States (RSPS) paper is a resource for the country’s state legislators and stakeholders interested in pro-growth economic reforms. The report breaks down a state’s standing into two major policy components; Economic Outlook Ranking and Economic Performance Ranking. The Economic Outlook Ranking forecasts a state’s current standing based on 15 policy variables. The Economic Performance Ranking is a backward-looking measure that looks at the gross domestic product, absolute domestic migration, and non-farm payroll employment.

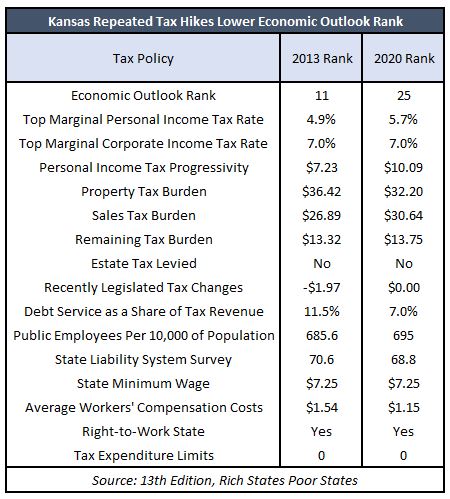

The adjacent table compares Kansas’s current economic outlook to 2013, the year it received its best ranking in RSPS. Sales and income tax measures were all significantly better in 2013 than they are on the 2020 ranking. Kansas’s top marginal tax rate is 16% higher than 2013 levels. Personal income tax progressivity, which burdens work and higher levels of income with higher taxation, is 40% higher than 2013 levels. The 2017 tax increase plays a role here as it’s the biggest tax increase in state history. The sales tax burden is also higher than 2013 levels, likely due to the tax increase package in 2015. While the 2020 ranking sees property tax improvement, Gov. Kelly’s government-friendly veto of Truth in Taxation legislation threatens that ranking in the future.

The adjacent table compares Kansas’s current economic outlook to 2013, the year it received its best ranking in RSPS. Sales and income tax measures were all significantly better in 2013 than they are on the 2020 ranking. Kansas’s top marginal tax rate is 16% higher than 2013 levels. Personal income tax progressivity, which burdens work and higher levels of income with higher taxation, is 40% higher than 2013 levels. The 2017 tax increase plays a role here as it’s the biggest tax increase in state history. The sales tax burden is also higher than 2013 levels, likely due to the tax increase package in 2015. While the 2020 ranking sees property tax improvement, Gov. Kelly’s government-friendly veto of Truth in Taxation legislation threatens that ranking in the future.

Also, Kansas grew in its share of public sector employees compared to 2013. Our 2020 Green Book also reflects this growth in government employees, noting Kansas has the 2nd highest local employees per capita. It also has a lower average workers’ compensation costs per $100 of payroll.

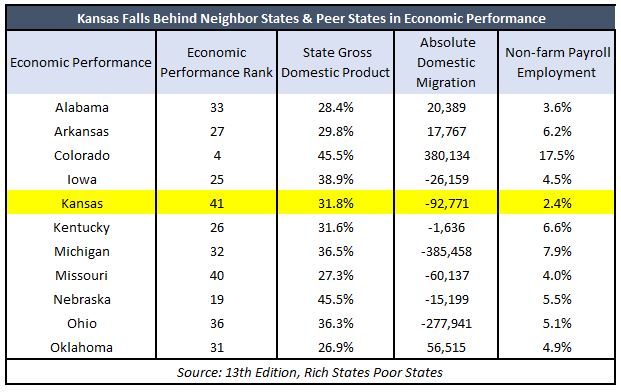

In terms of Economic Performance, Kansas has fallen behind its neighboring states and most states in the country. The table below highlights Kansas’s Economic Performance Rank with neighboring and peer states. From 2008 to 2018, Kansas gross domestic product rose 31.8%, which places us in the middle of the pack. However, 92,000 Kansans left for other states and countries from 2009 to 2018. Kansas had the worst migration showing among all except for Michigan and Ohio. Lastly, the state boasted a non-farm growth rate of 2.4%. Kansas job growth was also the slowest among neighbor and peer states.

Will Kansas’s economic outlook and overall performance decline as the pandemic and continued tax hikes take their toll? The answer is likely “Yes.” Denying Kansans 100% of the Tax Cuts and Jobs Act will be detrimental for Kansas’ income tax ranking. A Gov. Kelly veto of bipartisan property tax reform all-but ensures continued tax hikes at the local level. Also, the on-going Wayfair order will make it harder for small sellers to serve customers. Finally, the state losing 130,000 private jobs amid a government lockdown will most certainly drag the state back from seeing faster economic prosperity.