How much government is too much for Kansas? Three straight years of income tax increases are sending the state budget to another historical high. However, three signs suggest that bigger is not always better. Three signs; jobs, personal income, and purchases, that link government growth to a stagnant Kansas economy.

The legislature approved, and the Governor signed a state budget for 2019, that follows the Governor’s proposal pretty closely. In it, state spending is set to increase and hit a record $18.3 billion starting this fiscal year; the fiscal year in Kansas begins July 1.

Kansas Job Growth

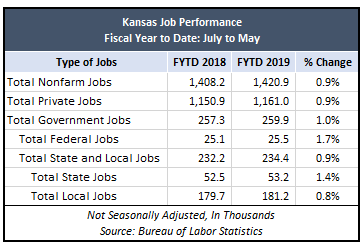

Private sector job growth hasn’t surpassed the 28-year average and is being outpaced by government job growth. The Bureau of Labor Statistics recently published Kansas job gains for the month of May. With it, we can get a good picture of Kansas’s job performance for the fiscal year 2019. For a point of reference, the 28-year average nonfarm job growth is 0.9% a year. Fiscal year to date (FYTD), total Kansas private jobs have grown 0.9% higher than the same time last fiscal year. State and local jobs have grown just as fast as the private sector. State government jobs are 1.4% higher than last year and the highest since 2011.

Private sector job growth hasn’t surpassed the 28-year average and is being outpaced by government job growth. The Bureau of Labor Statistics recently published Kansas job gains for the month of May. With it, we can get a good picture of Kansas’s job performance for the fiscal year 2019. For a point of reference, the 28-year average nonfarm job growth is 0.9% a year. Fiscal year to date (FYTD), total Kansas private jobs have grown 0.9% higher than the same time last fiscal year. State and local jobs have grown just as fast as the private sector. State government jobs are 1.4% higher than last year and the highest since 2011.

Kansas Income Growth

Income stemming from government services and jobs are driving much of the personal income gains in the state. Data from the first three quarters of the fiscal year 2019, has private earnings growing 3.2% and Proprietors’ income only 1% higher. Meanwhile, earnings from state and local jobs have risen 3% over the year. Kansas government is matching and, in some cases, surpassing, growth in private sector activity. For reference, the U.S. average has lower earnings growth from state and local jobs and has a far stronger growth rate from entrepreneurs and Americans in the private sector working 9 to 5. This means government employee wages are growing faster than private sector workers.

Income stemming from government services and jobs are driving much of the personal income gains in the state. Data from the first three quarters of the fiscal year 2019, has private earnings growing 3.2% and Proprietors’ income only 1% higher. Meanwhile, earnings from state and local jobs have risen 3% over the year. Kansas government is matching and, in some cases, surpassing, growth in private sector activity. For reference, the U.S. average has lower earnings growth from state and local jobs and has a far stronger growth rate from entrepreneurs and Americans in the private sector working 9 to 5. This means government employee wages are growing faster than private sector workers.

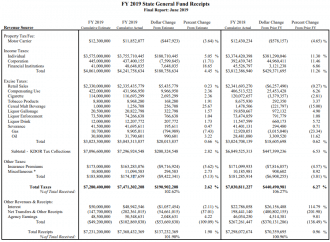

The latest government tax collections strongly suggest an effect on the new level of government spending. The state ended the fiscal year 2019 with $440 million in tax revenue over the fiscal year 2018, with 87% explained by personal income taxes. Sales tax, the tax on consumer purchases made in the state, fell by $6 million relative to last year. What could be the reason for the rise in personal income tax receipts, but a decline in sales tax? A booming economy isn’t one of them. More likely it’s the three straight years of personal income tax hikes, inflating income tax revenues but depressing consumer spending. A drop-in sales tax of $6 million means a $92 million drop in Kansas consumer sales. With more of Kansans’ paychecks going to pay taxes, the state is limiting opportunities of Kansas families.

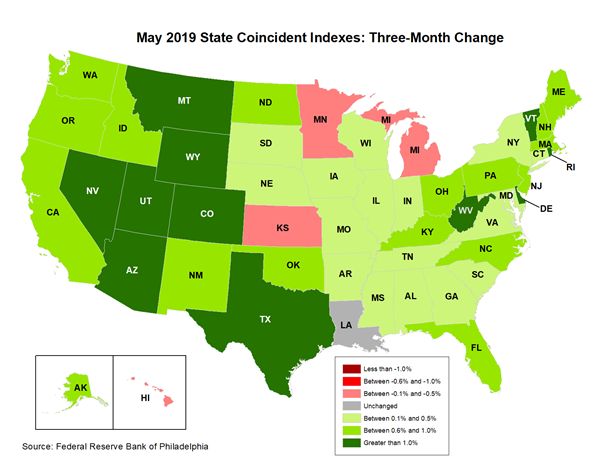

It seems in nearly every economic trend; expansive government is crowding out private opportunity. However, some may argue that an expansive government is what Kansas needs to prosper. While that may be the hope, it isn’t in step with the latest Kansas economic snapshot. The Federal Reserve Bank of Philadelphia complies an economic index for all 50 states in the U.S. Their most recent estimate in May shows Kansas is fourth from the worst performing state in the country.

Government growth surpassing the economy where most people work – private businesses – is not sustainable and eventually leads to less a floundering economy. When government jobs outpace the private sector, there are duplicate services and employers can find it challenging to hire Kansans on assistance or with government jobs. Record-setting spending and tax increases lead to depressed wages and spending, and a stalling economy. Kansas can take steps to increase efficiencies can by reducing unnecessary spending, or abiding by performance-based budgeting guidelines passed in 2016.

Kansas is in its fourth year of economic stagnation, and with the assist of a larger state government, it looks like the trend is set to continue. While the size of government can change in different dimensions, taxes and spending represent the clearest illustration of government growth and limited individual liberty.