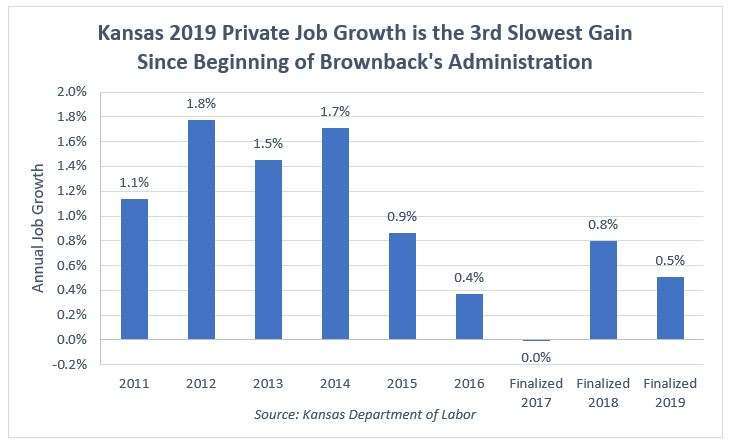

The final 2019 private jobs numbers are in and Kansas has underperformed. Despite assurances that Kansas was in a state of rebuilding, Kansas gained roughly 6,000 private jobs or 0.5% over 2018 levels. This job growth is the 3rd slowest job gain since the beginning of the Brownback Administration.

Earlier this month, we reported signs that Kansas job growth was actually much smaller than initially reported. Every month the Kansas Department of Labor (DOL) reports an estimate of Kansas job growth. These estimates, however, are not written in stone; they are merely predictions. Each March, the Kansas Department of Labor goes back to the last full year and revises their job growth estimates to match the census of jobs and wages, a hard count. Sometimes the benchmarking process results in job growth higher than initially reported. However, sometimes the benchmarking process results in a downgrade.

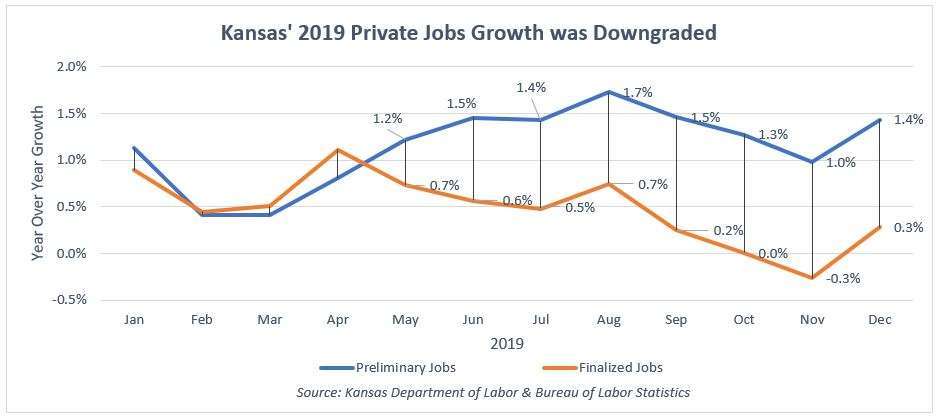

The chart below highlights Kansas’s downgrade in private sector jobs with the just-released data from DOL. The blue line is initial reports – estimates – of job growth. The orange line represents finalized job growth. Since May, actual job growth was less than half of the initial estimates. In fact, in November, Kansas lost private-sector jobs.

What does this mean for Kansas’s job growth under Gov. Kelly’s first year? It means instead of gaining roughly 13,000 private jobs, as was initially estimated, Kansas gained merely 6,000 or a 0.5% increase. That’s the 3rd slowest job gain since 2011. What could explain this anemic job performance?

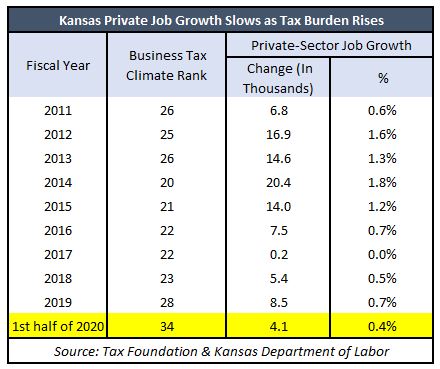

To answer that, the table below compares Kansas’s business tax climate rank from the Tax Foundation with private-sector job growth. On a fiscal year basis, Kansas received its lowest tax burden ranking of 20 in 2014. The lower the ranking, the more friendly the state business tax climate. This was the first year of the 2013 tax reform but before Kansas raised income and sales taxes in 2015. This relatively low tax burden coincided with high job growth of 1.8% or over 20,000 private jobs. Since then, the Kansas business tax burden has continued to climb.

To answer that, the table below compares Kansas’s business tax climate rank from the Tax Foundation with private-sector job growth. On a fiscal year basis, Kansas received its lowest tax burden ranking of 20 in 2014. The lower the ranking, the more friendly the state business tax climate. This was the first year of the 2013 tax reform but before Kansas raised income and sales taxes in 2015. This relatively low tax burden coincided with high job growth of 1.8% or over 20,000 private jobs. Since then, the Kansas business tax burden has continued to climb.

Kansas businesses have seen a reversal of the 2013 tax policy, the 8th highest sales tax in the country, vetoed legislation that would return the federal tax windfall to Kansans and businesses and the forcing out of state retailers to pay Kansas sales tax. The worsening tax climate and slower job growth are increasing the likelihood of a long and deep recession in Kansas. Considering the recent impacts of COVID-19, a further softening of Kansas job growth may be in the state’s immediate future. However, that does not mean a remedy is out of reach. Kansas can keep spending in check with the enforcement of performance based-budgeting. Policymakers can return the federal tax windfall to Kansans, or work to lower the overall tax burden.