Articles by:

Ganon Evans

2024 County Spending Comparison

Ganon Evans

Economic growth is a marathon, not a sprint

Ganon Evans

2023 Kansas payrolls: $2.48 billion

Ganon Evans

2024 Green Book

Ganon Evans

What’s going on with the federal Farm Bill?

Ganon Evans

Kansas has highest rural property taxes

Ganon Evans

What does effective tax relief look like?

Ganon Evans

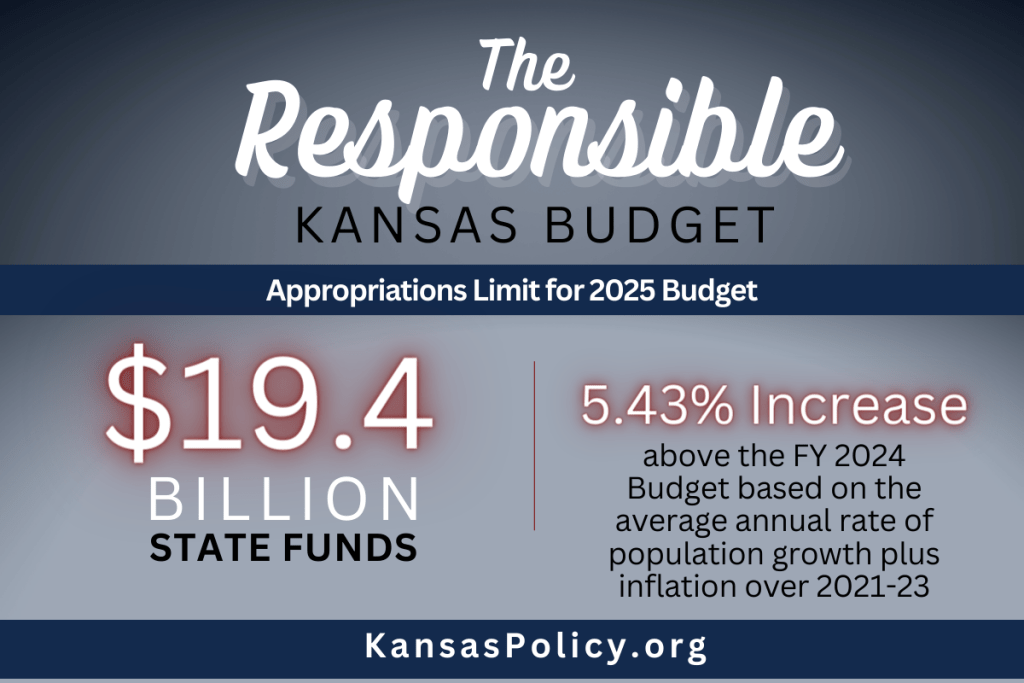

KPI Releases 2025 Responsible Kansas Budget

Ganon Evans

2025 Responsible Kansas Budget

Ganon Evans

Responsible budgeting key to tax reform

Ganon Evans

Five reasons for tax reform in 2024

Ganon Evans

Five ways Kansas can responsibly cut taxes

Ganon Evans

Reforming Kansas Tax Policy

Ganon EvansExamining four regulations on Kansas’s books

Ganon EvansKansas still swimming in excess revenue

Ganon EvansSteps to vaporize Kansas’s regulatory burden

Ganon Evans

Film subsidies are a box office flop

Ganon EvansOver 3,700 KPERS Millionaires in 2022

Ganon Evans2022 Kansas Payrolls: $2.36 billion

Ganon Evans

Kansas conference week round-up

Ganon Evans

3 ways Truth in Taxation empowers taxpayers

Ganon Evans

ESG-related bills stir discussion in Kansas

Ganon Evans

2023 Green Book

Ganon Evans

What is a Flat Tax?

Ganon Evans

What does ESG mean for Kansas?

Ganon Evans

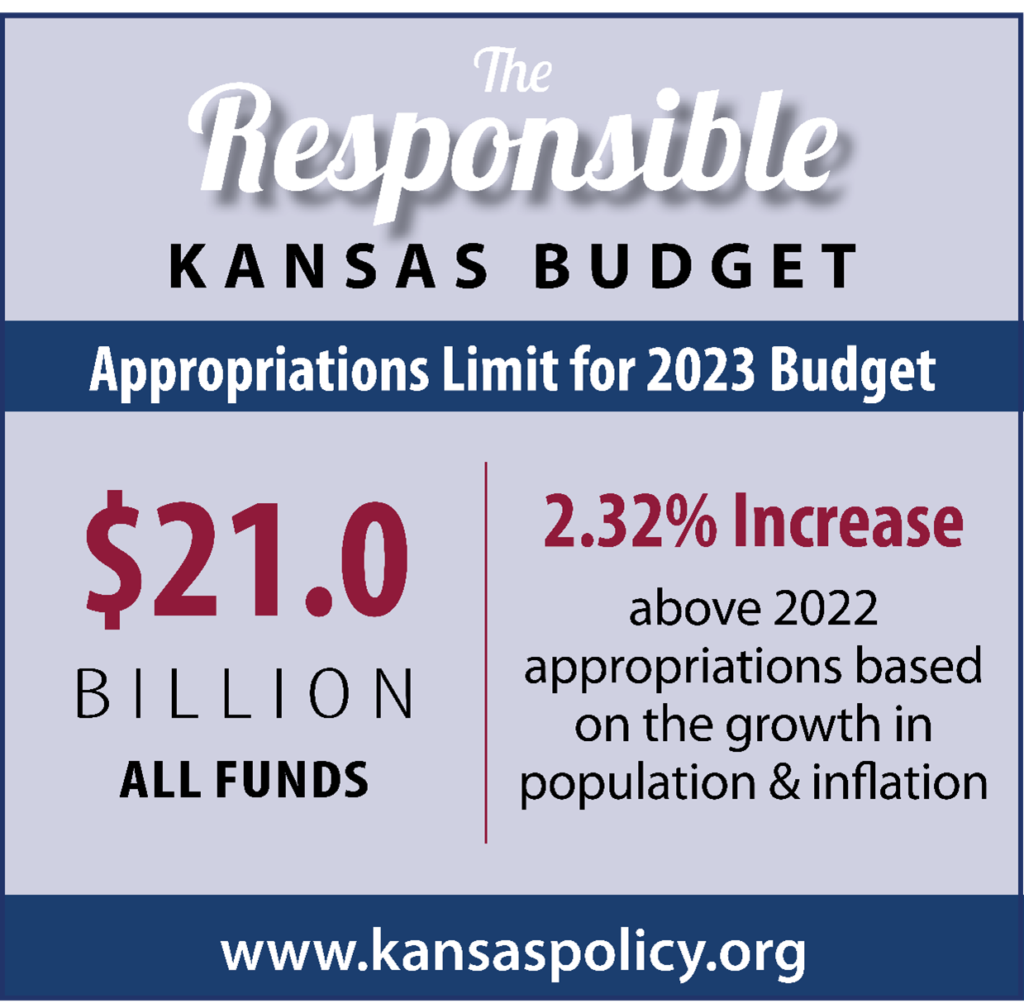

2024 Responsible Kansas Budget

Ganon Evans

The 2024 Responsible Kansas Budget

Ganon Evans

Debunking 6 Myths About a Flat Tax

Ganon Evans

Four Reasons for a Flat Tax

Ganon EvansViva la Flat Tax Revolution!

Ganon Evans

Combating inflation at the state level

Ganon Evans

Topeka relocation subsidy isn’t working

Ganon Evans

Saving Billions in Kansas Government Budgets

Ganon Evans

Cheap, Clean Energy Isn’t An Oxymoron

Ganon Evans

Tracking Kansas ARPA Funds

Ganon Evans

2022 Green Book

Ganon Evans2021 Kansas Payrolls: $2.26 billion

Ganon Evans

Time’s Not Yet Up for More Kansan Tax Relief

Ganon Evans

March 2022 Kansas Job Stagnation

Ganon Evans

What Savings Do Kansans Get With HB 2239?

Ganon EvansSimple Tax Reform Goes a Long Way

Ganon Evans

Thinking Responsibly About the Kansas Budget

Ganon Evans

What’s Causing Kansas Inflation?

Ganon EvansIdeas for ARPA and Kansas Revenue Cash Pile

Ganon EvansStreamlining State Regulations

Ganon Evans

Tax Revenue Highs Continue into January 2022

Ganon Evans

SB 347: The Mother of All Subsidies

Ganon Evans

2022 State of the State…With a Grain of Salt

Ganon Evans

The Responsible Kansas Budget

Ganon Evans

A Responsible Kansas Budget

Ganon EvansEntrepreneurship Resources in Kansas

Ganon Evans

How Free is Kansas in 2021?

Ganon Evans

Reforming Zoning Laws Reduces Housing Costs

Ganon Evans

Expanding Broadband Access in Kansas

Ganon Evans

Cutting Red Tape in Kansas

Ganon Evans

Solutions to Kansas’ High Property Taxes

Ganon Evans